Good Morning! We hope this edition finds you well. We are kickstarting this year right with lots of new updates and features we can now offer our clients! If you, a family member or friend can benefit from 1%+ lower rates on a new home purchase or accessing equity without impacting your mortgage, you’re going to want to check this out!

“When you share knowledge with those you hold dear, you're not just enriching their minds; you're enriching their lives."

Performance Stats

$23,381,804 Total Funded Volume

73 Families helped close on a loan!

1. Now Offering Lender Credits for Buydown Programs on Conventional/VA Loans!

The housing market is constantly in a state of flux. It's ever so important to understand all available tools and resources to obtain the most competitive rates on the market. One tool everyone should have on their radar is "buydown programs," which can help reduce your interest rate by a certain percentage over a short period of time, typically the first 1-3 years of a loan. These programs are typically funded through seller credits or realtor credits, where either the seller of the home or your real estate agent has negotiated or offered to pay for the cost.

If you’ve never heard about buydown programs or are unsure how they work, please check out our complete guide that breaks down how crucial it can be to qualify 👇

Depending on the “Buyers/Sellers Market” dynamic or the skill set of you and your agent to negotiate terms to receive these credits, it may be difficult to obtain enough to take advantage of these programs

Agave Now Offering Lender Credits!

We make things easy and simple. In certain states* with Conventional and VA loans, Agave Home Loans is able to offer "Lender Credits" to help cover the costs of these buydown programs!

This now allows us to offer at least 1% lower than the market rate for the first year on new home purchases, saving you hundreds on your monthly payment!

If you or a loved one was sidelined because of high rates, this is the resource you need to look into.

If you want to find out what rates and programs you qualify for based on your personal profile, please fill out this form 👈

*States we can offer this service currently: AZ, CA, CO, FL, GA, OR, PA, SC, TN, VA, WA

2. Market Rundown

Rates are up from December slightly according to Freddie Mac

3. Introducing The 5 Day HELOC!

We are now offering Home Equity Lines of Credit! No appraisals needed, no prepayment penalties, no balloons, no variable rate, customize your terms (5, 10, 20, or 30 year terms), and limited documents required. Information sent directly to your cell phone/email for super easy approval! Yes, we can even do small loan amounts!

Once you select and approve your terms, funding is as little as 5 days!

Recommended:

- 620+ Credit Score. (Higher approval chances with higher scores 700+)

- Have Equity in Your Home

- Have a need to access your equity

Information Needed:

- Address

- Birthday

- Estimated Gross Income

- Email Address

- Permission to do a soft check only

Great to use to help complete home improvements, consolidate debt, or even invest! Click on the photo above or reach out to us directly here!

4. Top Mortgage News

Home Sales Increased 3% to Start the Year (CNBC)

Fed Meeting: Rates Holding Steady, No Decreases…Yet (JPMorgan)

Is it Worth Paying Points to Reduce Your Interest Rate? (FreddieMac)

(Articles are not endorsed in any matter by Agave Home Loans)

5. Sticky Media: Broke Millennial…

This one goes out to all our Millennials out there trying to make it in the world. We know that life is tough, inflation is high, and it can be hard to think about anything outside the day to day. The Broke Millennial Book is a great starter book for anyone looking to help guide you on your first steps to a better life. There’s only so many ways you can budget but this book really helps put strategies into plain english.

Here is a short excerpt from the book: “If you’re a cash-strapped 20- or 30-something, it’s easy to get freaked out by finances. But you’re not doomed to spend your life drowning in debt or mystified by money. It’s time to stop scraping by and take control of your money and your life with this savvy and smart guide.

Broke Millennial shows step-by-step how to go from flat-broke to financial badass. Unlike most personal finance books out there, it doesn’t just cover boring stuff like credit card debt, investing, and dealing with the dreaded “B” word (budgeting).”

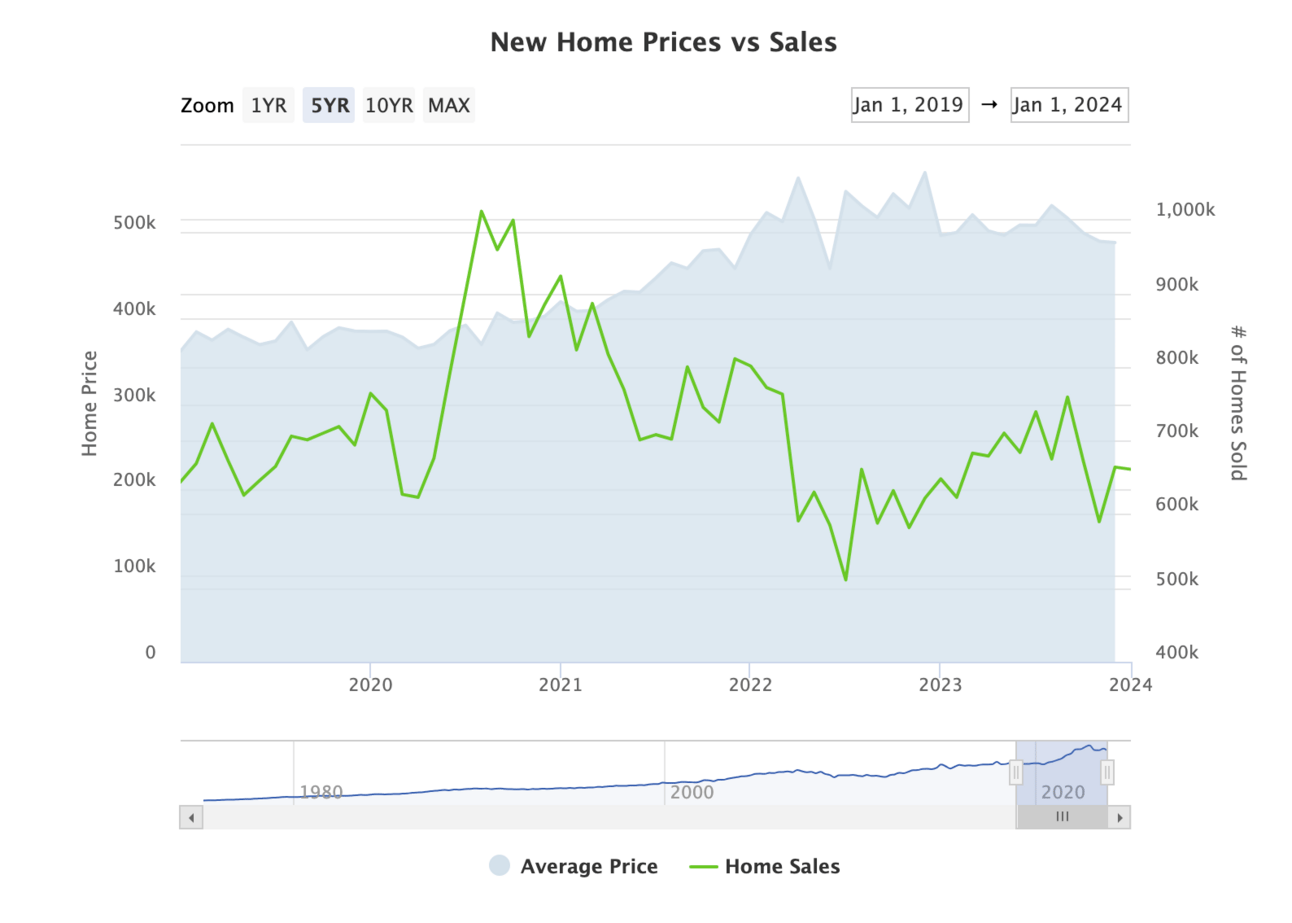

6. Sweet Visuals: New Home Prices

Average Home Prices Over Last 5 Years

Home Sales vs Housing Prices Over the Last 5 Years

Source: Mortgage News Daily

If you have worked with us in the past, please write a review on Yelp! We truly appreciate all clients we have helped in the past and reviews help us in so many ways.

Be sure to follow us on Facebook, Instagram, Twitter, YouTube and LinkedIn for finance tips, positive news stories, giveaways, and so much more!

Did you like this edition of the newsletter?

***

AGAVE HOME LOANS

MORTGAGE BROKERAGE

PHONE 888.300.3440

EMAIL [email protected]

WEB www.agavehomeloans.com

AGAVE NMLS #1951574

LICENSES:

Arizona - 1007729

California DFPI - 60DBO-112121

Colorado - 100517095

Florida - MBR4543

Georgia - 71608

Michigan - FL0023996

Montana - 1951574

North Carolina - L-221352

Oregon -1951574

Pennsylvania - 81635

South Carolina - DCA-1951574

Tennessee - 1951574

Virginia - MC - 7701

Washington - CL-1951574

New Jersey - 1951574

Alabama - 1951574