Good Morning! As the air crisped up and the leaves changed colors, we hope you enjoyed your favorite pumpkin-flavored beverage. This fall was not an easy time for those in the industry, having faced one of the worst markets in two decades. As we hunkered down to find families who needed help, we realized that in order to grow, we sometimes have to find alternatives or let things go. A lesson from nature perhaps that you only need the barebones to survive the winter to flourish in the spring. We hope you enjoy this quick recap so grab a blanket, snuggle up, and let's leaf through the latest in mortgage news together!

"As we let go of what no longer serves us, we make room for new beginnings and brighter tomorrows." - Unknown

Performance Stats

$43,729,628 total funded volume

153 Families helped close on a loan!

1. Personal Loan vs. Refinancing: Making the Right Financial Move

In the realm of personal finance, the choice between a personal loan and refinancing often presents itself, each with its own set of advantages and considerations. Let's explore the key pros and cons of both options to help you make an informed decision on which avenue may be best suited for your situation.

Personal Loan: Flexibility and Accessibility

Pros:

Versatility: Personal loans offer flexibility in usage, allowing borrowers to address various financial needs, from debt consolidation to unexpected expenses.

Predictable Payments: With fixed interest rates and repayment schedules, personal loans provide stability and predictability in budgeting.

Quick Access: The streamlined application process means borrowers can access funds swiftly, making it ideal for urgent financial needs.

Cons:

Higher Rates: Personal loans often come with higher interest rates, especially for borrowers with less-than-perfect credit histories.

Limited Amounts: There's a cap on borrowing limits, which may not suffice for significant expenses or debt consolidation.

Debt Accumulation Risk: Without careful management, easy access to funds can lead to increased debt accumulation.

Refinancing: Restructuring for Efficiency

Pros:

Interest Savings: Refinancing allows for lower interest rates, potentially resulting in significant savings over the loan term.

Extended Terms: By extending the repayment period, borrowers can reduce monthly payments and improve cash flow management.

Debt Consolidation: Refinancing offers the opportunity to consolidate multiple debts into a single, more manageable loan.

Cons:

Closing Costs: Refinancing involves closing costs and fees, which can offset potential savings and require careful consideration.

Extended Debt Burden: While monthly payments may decrease, extending the loan term could lead to higher overall interest costs.

Credit Requirements: Securing favorable refinancing terms depends on creditworthiness, potentially posing challenges for those with less-than-ideal credit.

Making Your Choice

When deciding between a personal loan and refinancing, consider factors like your financial goals, current interest rates, and creditworthiness. Research thoroughly, compare offers, and seek advice from financial experts to ensure alignment with your overall financial strategy. Personal loans may be an easy way to complete your goals however can increase your changes of not qualifying for any equity financing in the future. While you’re shopping around for solutions, consider looking into home equity options to see if anything makes financial sense.

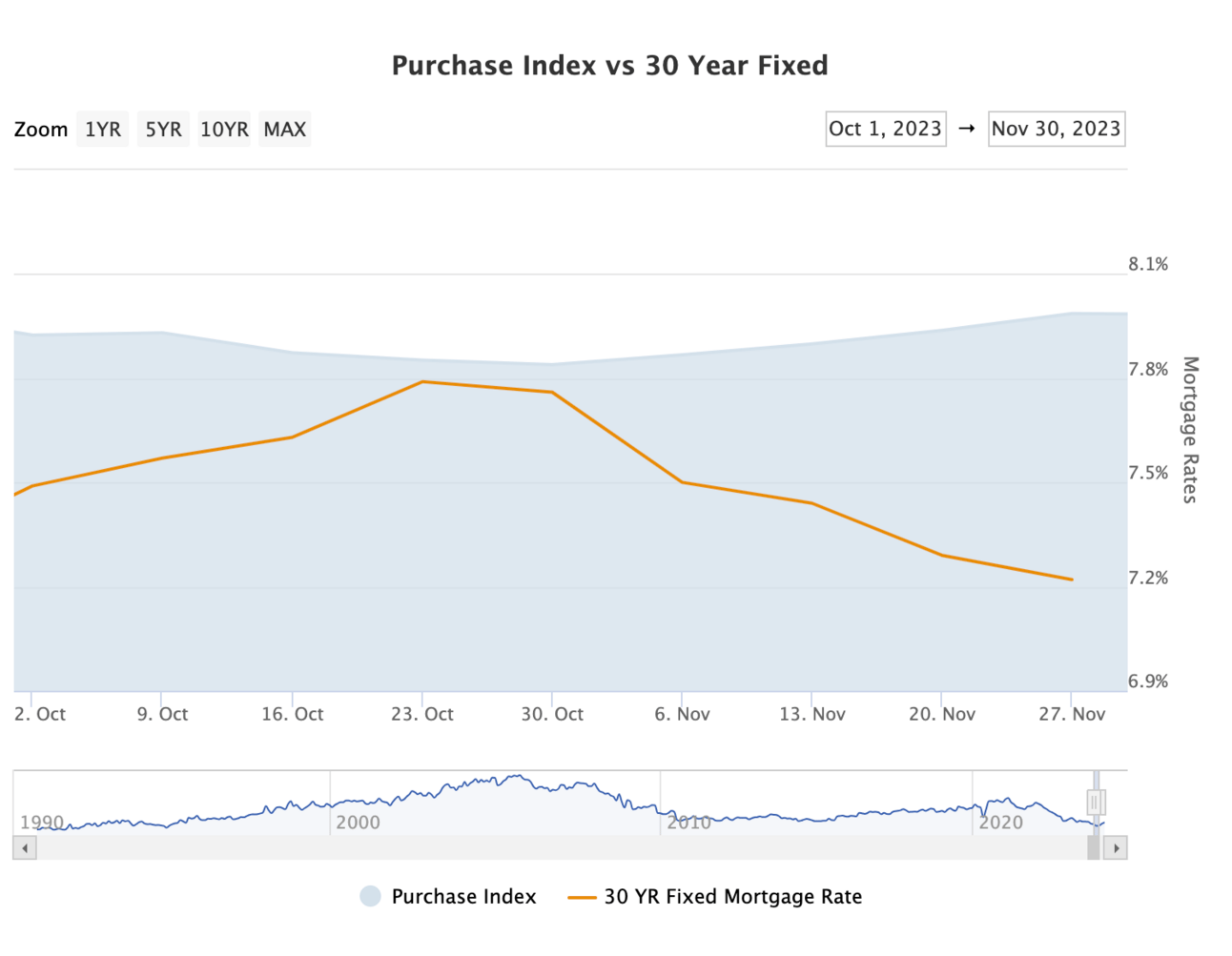

2. Markets Rundown

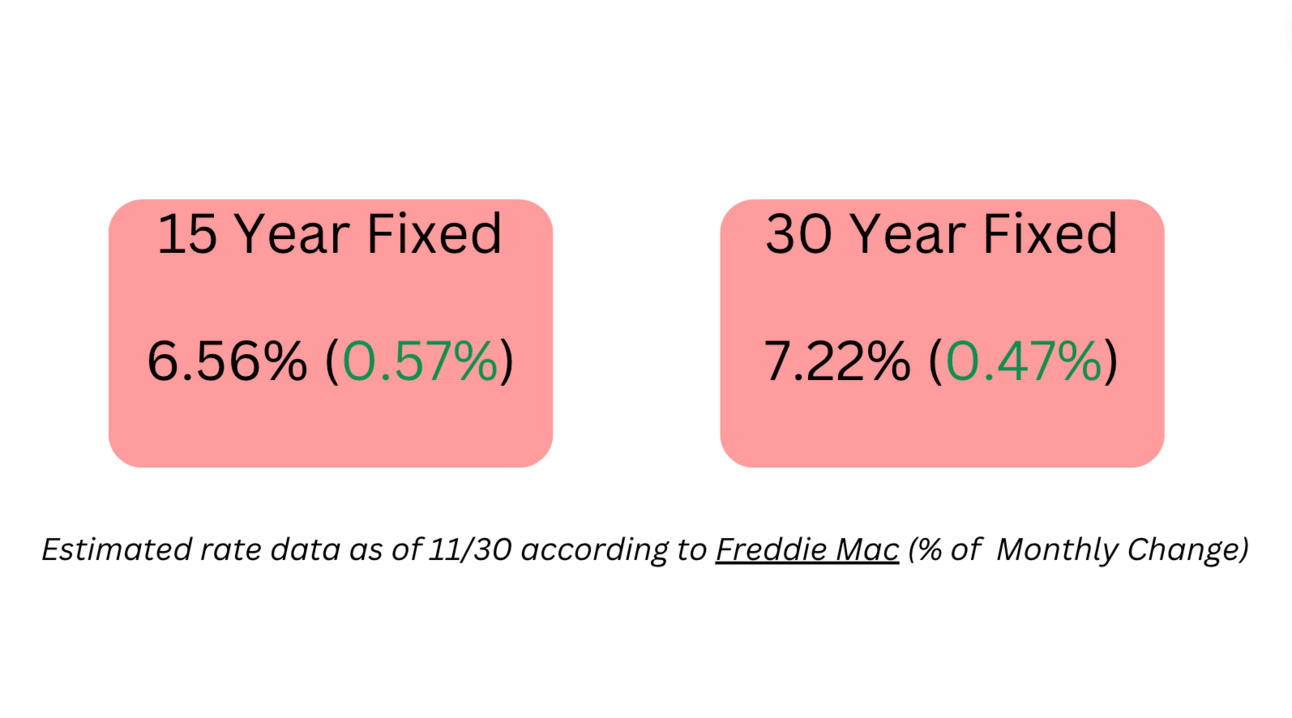

If you want to find out what discounted rates are based on your personal profile, please fill out this form .

Rates remained at in all time high through Oct around 7.8% on a 30 Year, while finally dropping in Nov according to Freddie Mac.

3. Top Mortgage News

New Tax brackets incoming for 2024 (IRS)

Home Sales hit 13-Year Low (Investopedia)

Rates highest they’ve been in 23 Years (Reuters)

(Articles are not endorsed in any matter by Agave Home Loans)

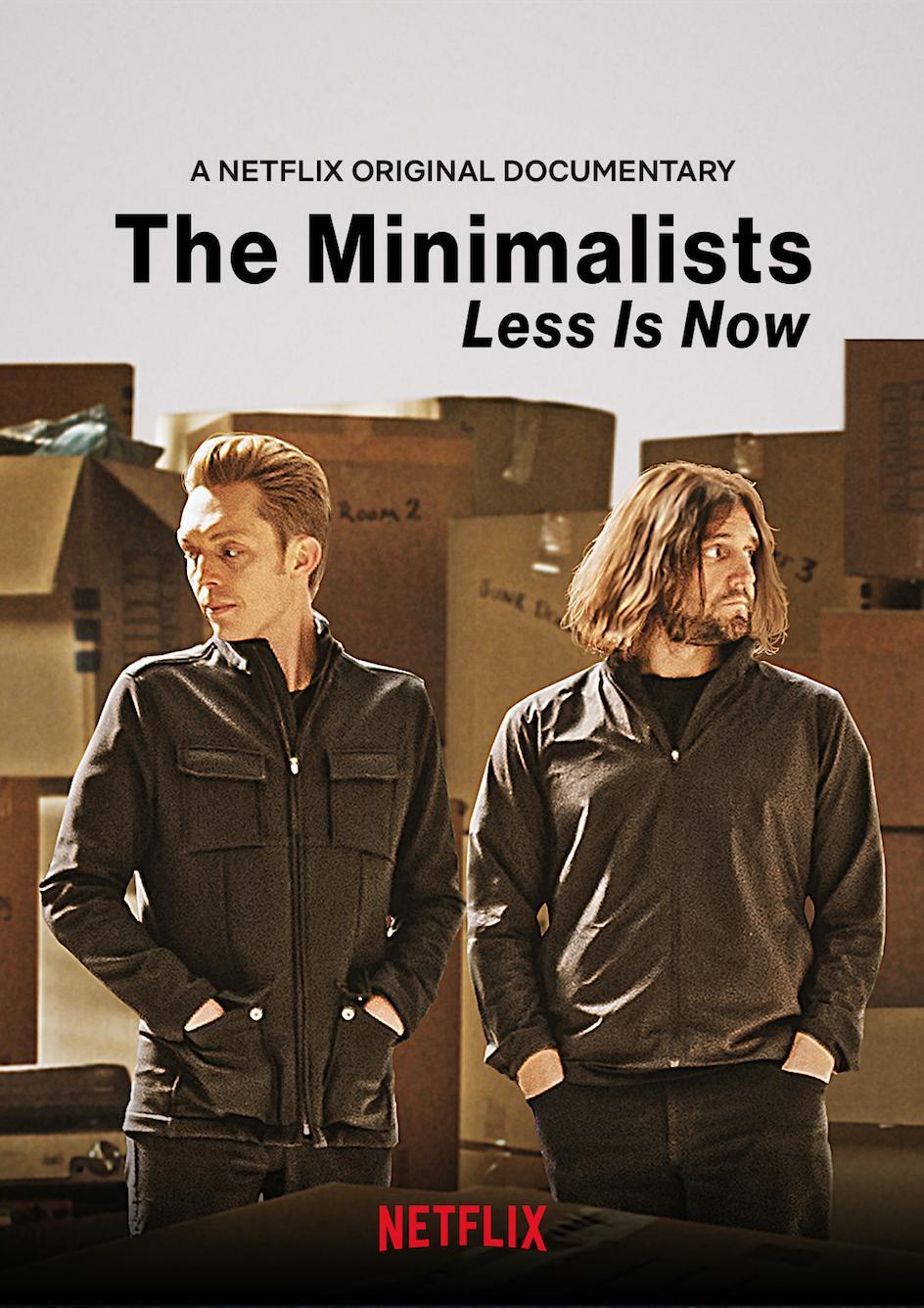

4. Sticky Media: The Minimalists

The Minimalists are Emmy-nominated Netflix stars and New York Times–bestselling authors Joshua Fields Millburn and Ryan Nicodemus. Alongside their podcast cohost, T.K. Coleman, they help millions of people live meaningful lives with less.

The concepts that Joshua, Ryan and TK cover are insightful in more ways than one. Learning how to be mindful and apply tactics to multiple aspects of your well-being can be life-changing. We as people can get so easily caught up in the highlights of having more that it either puts us in a financial hole or blinded by money. For those of us who could use a reset, we’d encourage anyone to listen to a few episodes or if you have the time one weekend, to watch their documentary (I’ve attached the full 100% free version from youtube for your enjoyment)

In short, less is more and is always worth having in the right lens.

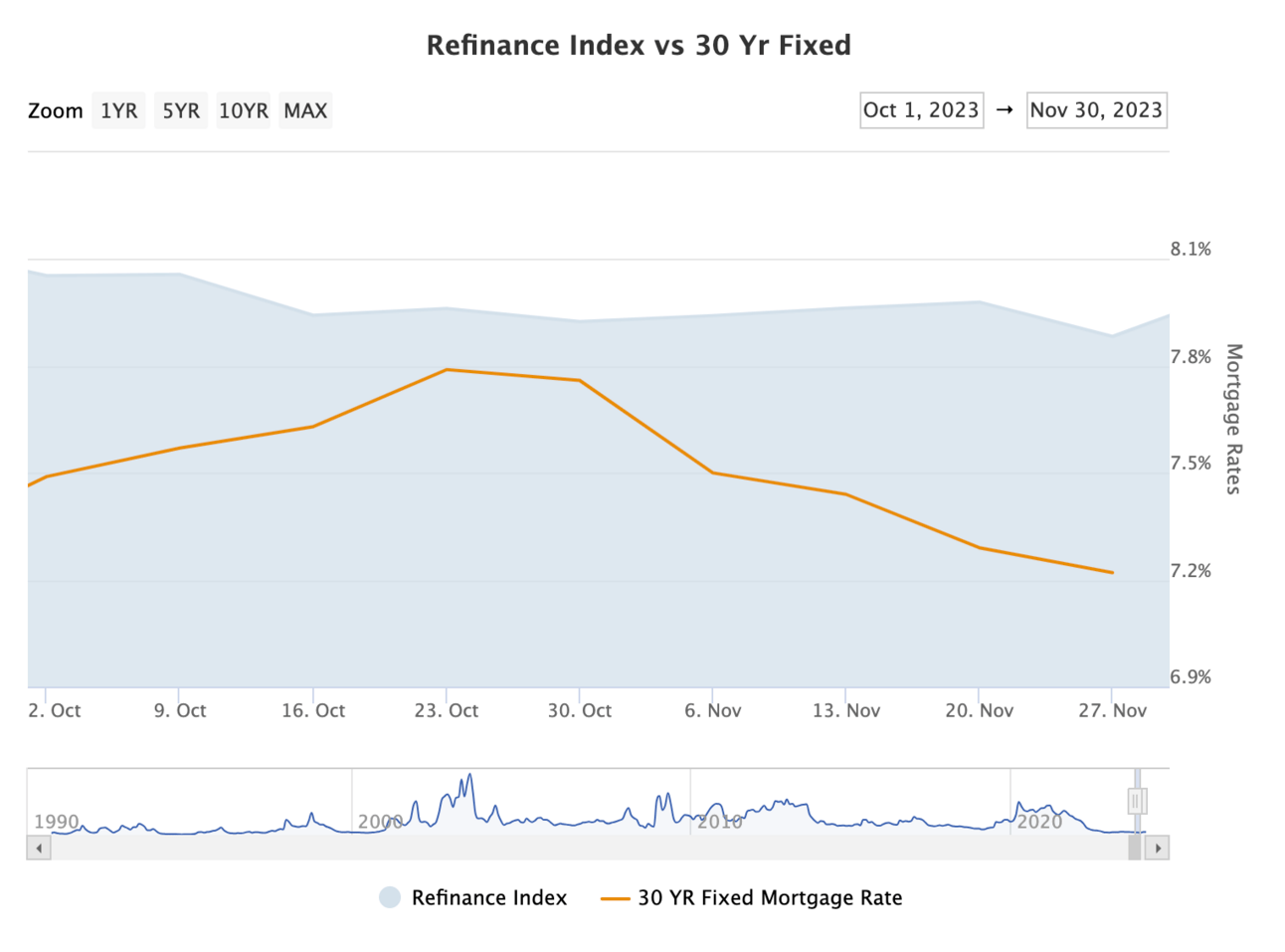

5. Sweet Visuals: Mortgage Applications

Average Refinance Mortgage Applications from October to November

Average Refinance Mortgage Applications from October to November

Source: Mortgage News Daily

Missed Last Months Edition? No worries, check it out below!

Want More Agave?

Subscribe to our Youtube channel! We are still ramping up but you’ll get access to:

Market deep-dives & discussions

Realtor Interviews: in’s and out’s of the real state market

Deeper understanding of complex mortgage topics

Loan Officer trainings and a backstage look at what it takes to be a Loan Officer

See you on YouTube!

If you have worked with us in the past, please write a review on Yelp! We truly appreciate all clients we have helped in the past and reviews help us in so many ways.

Be sure to follow us on Facebook, Instagram, Twitter, YouTube and LinkedIn for finance tips, positive news stories, giveaways, and so much more!

Did you like this edition of the newsletter?

***

AGAVE HOME LOANS

MORTGAGE BROKERAGE

PHONE 888.300.3440

EMAIL [email protected]

WEB www.agavehomeloans.com

AGAVE NMLS #1951574

LICENSES:

Arizona - 1007729

California DFPI - 60DBO-112121

Colorado - 100517095

Florida - MBR4543

Georgia - 71608

Michigan - FL0023996

Montana - 1951574

North Carolina - L-221352

Oregon -1951574

Pennsylvania - 81635

South Carolina - DCA-1951574

Tennessee - 1951574

Virginia - MC - 7701

Washington - CL-1951574

New Jersey - 1951574

Alabama - 1951574