Good Morning! Spring is in full swing, and we hope you have been enjoying the outdoor season before the hot summer rolls around. Decluttering can be a breath of fresh air, and if you haven't started your spring cleaning regimen yet, now's the time! Out with the old and in with the new, as they say, and it may be time to take a hard look at your financial life to see how you can freshen things up and start anew!

"Success is the sum of small efforts, repeated day in and day out." - Robert Collier

Performance Stats

$21,814,230 in funded volume

62 closings

94 submissions

$32,927,948 in submitted underwriting volume

1. When Should You Refinance?

Owning a home is like having a child: it's a huge responsibility, it takes a lot of money, and sometimes you just want to scream and run away. But unlike children, homes can actually help you solve some of life's most pressing problems - like debt. If you're a homeowner with debt, refinancing your home might be the perfect solution. But when should you take the plunge? Here are some sweet tips and tricks to help you decide.

First, it's important to understand what refinancing is. Basically, when you refinance your home, you're replacing your current mortgage with a new one. This new mortgage can have a lower interest rate, a different term (i.e. the number of years you have to pay it off), or both. By refinancing, you can potentially save money on your monthly payments and/or pay off your debt more quickly.

So, when should you refinance to pay off debt? Here are some signs that it might be time:

You have high-interest debt. Credit cards, personal loans, and other types of debt can come with sky-high interest rates. If you're struggling to make payments on these debts, refinancing your home to pay them off can be a smart move. By consolidating your debt into your mortgage, you can take advantage of your home's lower interest rate and potentially save thousands of dollars in interest charges over time.

You have equity in your home. Equity is the difference between your home's current value and the amount you owe on your mortgage. If you've been paying your mortgage for a while, you may have built up a significant amount of equity. Refinancing can allow you to tap into this equity and use it to pay off your debt.

You have a stable income. Refinancing your home to pay off debt can be a smart move, but it's not without risks. If you can't make your mortgage payments, you could lose your home. That's why it's important to have a stable income before you refinance. Make sure you can afford your new mortgage payment, even if your income fluctuates.

You're committed to staying in your home. Refinancing your home can be a good idea if you plan to stay in your home for the long term. If you're planning to sell your home soon, refinancing might not be worth it. The costs of refinancing can be high, and you might not recoup those costs if you sell your home soon after.

If you decide to refinance to pay off debt, there are a few tips and tricks to keep in mind:

Shop around for the best deal. Refinancing can be expensive, so it's important to shop around for the best deal. Compare rates and terms from different lenders to find the one that works best for you.

Consider all the costs. Refinancing can come with a lot of hidden costs, like closing costs, appraisal fees, and more. Make sure you understand all the costs involved before you make a decision.

Use the money wisely. Refinancing to pay off debt can be a great way to get a fresh start, but it's important to use the money wisely. Don't use it to take on new debt or make frivolous purchases. Instead, use it to pay off high-interest debt and improve your financial situation.

In conclusion, refinancing your home to pay off debt can be a smart move if you're in the right situation. If you have high-interest debt, equity in your home, a stable income, and a commitment to staying in your home, refinancing could be the solution you've been looking for. Just remember to shop around for the best deal, consider all the costs, and use the money wisely

To read more about how to refinance, check out our article!

2. Markets Rundown

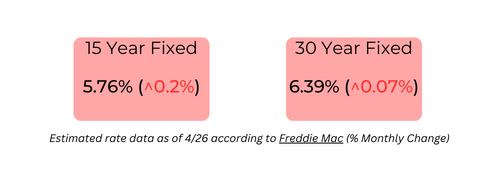

If you want to find out what discounted rates are based on your personal profile, please fill out this form .

Rates are slightly higher than last month but overall lower than national average according Freddie Mac

3. Realtor of the Month

About:

Hi, my name is Sarah Silverman and I am an agent at Walt Danley Local Luxury Real Estate | Christie’s International Real Estate, previously known as Local Board Real Estate. I was born and raised in Scottsdale, Arizona and went to ASU for undergrad. I think the main reason I became a realtor is because I’m a people person who enjoys solving problems and helping people find their dream home is a great way to use my skills - it has been very fulfilling having a career that I love doing!

Hobbies:

In my free time I enjoy going to sports events, being outside, and lounging by a pool, especially in the summer! Favorite food is hard because I’m quite the foodie but I guess I would have to say anything sweet - nothing beats a homemade chocolate chip cookie fresh out of the oven!

Favorite TV Show:

My favorite tv show is definitely breaking bad, I’ve watched it from start to finish at least 4 times and it never gets old.

Goals:

In 5 years, I hope to help many families find their dream homes and end up very happy with the customer service I have provided. For me it is less about sale volume and amount of money I bring in - I am more invested in having satisfied clients and helping families get the amazing service that they deserve since buying a home is sometimes the biggest decision they will ever make.

Contact Info:

Phone: 480-694-4994

Email: [email protected]

LICENSE #: SA703223000

MLS ID: ss1130

Do you know a realtor? Please refer them to us! We’d love to hear and feature them on future editions!

4. Top Mortgage News

40 Year mortgages become popular on TikTok (Morning Star)

Refinancing may be more expensive for good credit owners? (Yahoo! Finance)

First Republic Bank goes under, acquired by JPMorgan (CNBC)

Federal Reserve raises interest rates (federalreserve.gov)

Mortgage applications had a slight dip this month but overall trending upwards (MortgageNewsDaily)

Fun Fact: WE ARE NOW LICENSED IN MONTANA!

5. Monthly Read: Atomic Habits

"Atomic Habits" by James Clear is a game-changer for anyone looking to level up their life. We have used the teachings in this book to help our teammates become better organized and implement strategies for growth. Here are a few life lessons and takeaways that can benefit readers:

Small changes matter: Clear emphasizes the power of small, incremental changes or "atomic habits" that may seem insignificant at first, but add up to significant results over time. This reminds us that every little step we take towards building good habits and breaking bad ones matters, and that we don't need to make drastic changes to see progress.

Practical strategies for habit-building: The book provides practical strategies like habit stacking (linking new habits to existing ones) and setting SMART goals (Specific, Measurable, Achievable, Relevant, Time-bound) to help readers build and sustain positive habits. These strategies offer practical tools that can be implemented in everyday life to create lasting change.

Self-awareness is key: The importance of self-awareness in understanding our habits and behavior. By being aware of our cues, routines, and rewards, we can identify patterns and make intentional changes to our habits. This emphasizes the need to reflect on our actions and motivations to make meaningful changes in our lives.

Environment matters: By designing our environment to support our desired habits, we can make it easier to stick to positive behaviors and break free from negative ones. This underscores the importance of creating an environment that aligns with our goals and values.

Self-compassion is crucial: The need for self-compassion and self-forgiveness in the habit-building process is critical. Setbacks and failures are a part of the journey and encourages readers to be kind to themselves when facing challenges. This reminder helps readers approach their habits with a positive and forgiving mindset, fostering a healthier relationship with themselves and their habits.

"Every action you take is a vote for the type of person you wish to become." - James Clear, Atomic Habits

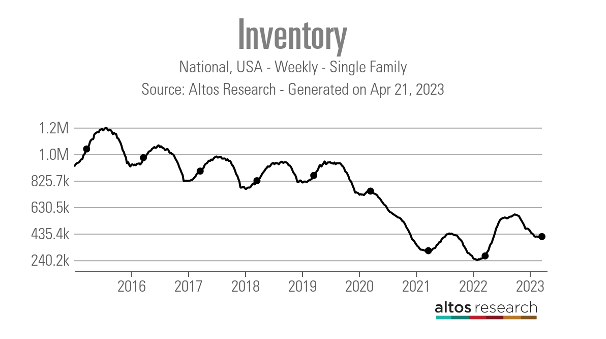

6. Sweet Visual: Housing Inventory

Single family homes inventory over time (2016-2023)

Source: Housing Wire/Altos Research

Want more Agave?

Subscribe to our Youtube channel!. We are still ramping up but you’ll get access to:

Market deep-dives & discussions

Realtor Interviews: in’s and out’s of the real state market

Deeper understanding of complex mortgage topics

Loan Officer trainings and a backstage look at what it takes to be a Loan Officer

See you on YouTube!

*****

Did you like this edition of the newsletter?

AGAVE HOME LOANS

MORTGAGE BROKERAGE

PHONE 888.300.3440

EMAIL [email protected]

WEB www.agavehomeloans.com

AGAVE NMLS #1951574

LICENSES:

Arizona - 1007729

California DFPI - 60DBO-112121

Colorado - 100517095

Florida - MBR4543

Georgia - 71608

Michigan - FL0023996

Montana - 1951574

North Carolina - L-221352

Oregon -1951574

Pennsylvania - 81635

South Carolina - DCA-1951574

Tennessee - 1951574

Virginia - MC - 7701

Washington - CL-1951574

New Jersey - 1951574

Alabama - 1951574