Good Morning! The positive shift we talked about last month is here, and the momentum is building. In this edition, we'll cover the Fed's recent rate cut and look ahead to the next one, which is already on the horizon.

This Month’s quote: "The trend is your friend"

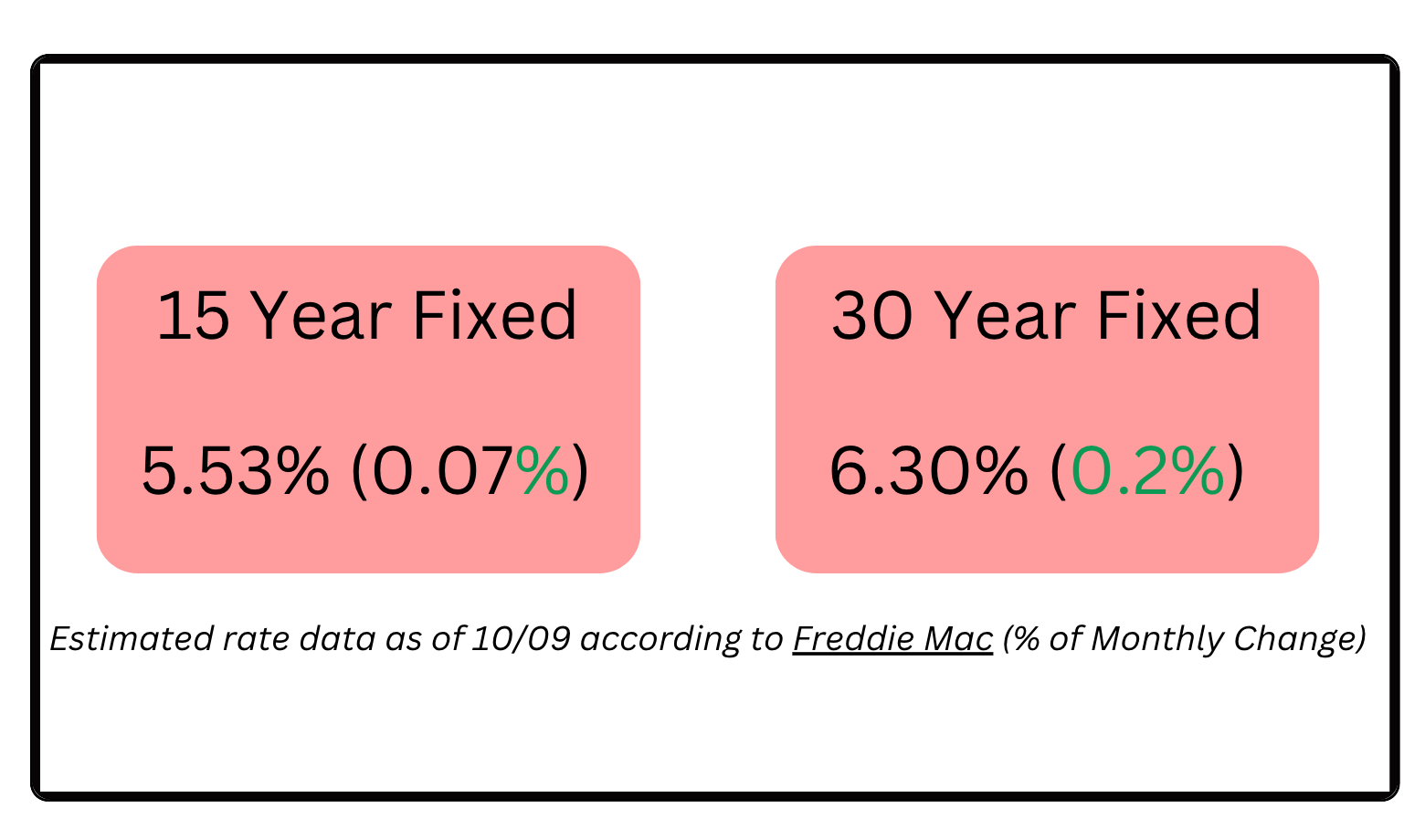

What’s The Rate?

Average rates for primary homes with % changes from May according to Freddie Mac

Top Mortgage News

Rates Expected to Move Below 6 Percent by End of 2026 (FannieMae)

New Legislation Seeks to Expand Mortgage Access for Crypto Investors (MortgagePoint)

NAR Applauds Senate Passage of the ROAD to Housing Act (NAR)

Trump Signs “Trigger Leads” Bill (consumerfinancemontior)

Rate/Term Refis Surge Over 180% (MCT)

Government Shutdown Disrupts Housing Data (realtor.com)

(Articles are not endorsed in any matter by Agave Home Loans)

Performance Stats

$33,131,368 Total Funded Volume in August

164 Families helped close on a loan!

The Fed Cut Rates in September. Another Drop is Likely in October

Last month, we highlighted the high probability of a Federal Reserve rate cut, and they delivered. By lowering the benchmark rate to 4.00%–4.25%, the Fed sent a clear signal that the long period of rate hikes is over, and a new phase of economic easing has begun.

This is welcome news for anyone with a variable-rate loan (like credit cards or HELOCs), as borrowing costs are starting to trend down. While mortgage rates don't move in lockstep with the Fed, this downward pressure is a positive sign for the housing market. In fact, we've already seen mortgage rates drop by almost 1% over the last three months.

What's Next? The Trend is Likely to Continue.

The good news doesn't stop in September. As you can see from the latest market data, there is a 97.8% probability that the Fed will cut rates again at their October 29th meeting, likely bringing the new target range to 3.75%–4.00%.

This back-to-back easing signals a clear trend. For homebuyers and homeowners, this continued downward momentum is creating a valuable window of opportunity. Affordability is improving, and the case for refinancing is getting stronger each month.

If you've been waiting on the sidelines, now is the time to pay attention. This trend could unlock significant savings and buying power as we head into the final quarter of the year.

If you’re curious how these changes could impact your home financing options, keep reading to learn about the rate and term option and how it can save you thousands over time!

Is It Time to Refinance? Understanding the Rate-and Term

As the market shifts and interest rates begin to fall, many homeowners are wondering if now is the right time to refinance. One of the most straightforward and powerful ways to do this is with a rate-and-term refinance, a strategy designed to improve your mortgage without taking cash out of your home.

The goal is simple: replace your existing mortgage with a new one that offers better terms. This is a smart move for homeowners looking to take control of their financial future.

Top Reasons to Consider a Rate-and-Term Refinance:

Lower Your Monthly Payment: The most popular reason to refinance is to secure a lower interest rate, which directly reduces your monthly payment and frees up cash for other financial goals.

Pay Off Your Home Faster: You can switch from a 30-year loan to a shorter term, like a 15 or 20-year mortgage. While your payment might be slightly higher, you'll build equity faster and save tens of thousands of dollars in interest over the life of the loan.

Gain Stability with a Fixed Rate: If you have an adjustable-rate mortgage (ARM), refinancing allows you to lock in a stable, predictable fixed rate. This protects you from future rate hikes and brings peace of mind to your budget.

Is It the Right Move for You?

A rate-and-term refinance is ideal if your primary goal is to optimize your mortgage rather than borrow against your equity. While there are closing costs to consider, the long-term savings from a lower rate often make it a worthwhile investment.

If you're curious whether a rate-and-term refinance could help you save money or achieve your financial goals faster, let's connect and explore your options.

Sweet Visuals: Fed Dot Plot & Rate Drop Savings

Fed Rate Prediction for October Meeting: 97.8% chance rate cut of another 0.25%-0.5%

Source: FedWatch

Sticky Media: The Stacking Benjamins Show

If you think personal finance has to be dry and boring, you haven’t listened to The Stacking Benjamins Show. Hosted by Joe Saul-Sehy, this podcast delivers practical financial wisdom with a heavy dose of humor, making complex topics feel like a fun, engaging conversation rather than a lecture. It’s the perfect listen for anyone looking to get smarter with their money without being put to sleep.

A great place to start is their recent episode, "How to Make Better Decisions Using Math (with Ted Dintersmith)." The episode explores a fascinating idea: we often make major life choices—like buying a home or choosing a career—based on gut feelings, when a little bit of simple math could lead us to a much better outcome. Dintersmith argues that by applying basic probability and analysis, we can move beyond emotion to make decisions that truly align with our long-term goals for wealth and happiness.

This episode is a powerful reminder that the best financial moves aren't just about numbers on a spreadsheet; they're about improving your decision-making process itself. It perfectly bridges the gap between abstract data and real-world results, giving you a new framework for tackling life's biggest questions.

Check them out on Apple Podcast!

Agave Merch Shop is Open!

Agave Reverse Snapback

Agave Reverse Snapback!

From closing day to every day, our new two-tone snapback is the perfect way to show your Agave pride. Built for comfort and style, this is a limited run—so grab yours before they're gone!

Be sure to follow us on Facebook, Instagram, and LinkedIn for finance tips, mortgage news, giveaways, and more!

Did you like this edition of the newsletter?

***

AGAVE HOME LOANS

MORTGAGE BROKERAGE

PHONE 888.300.3440

EMAIL [email protected]

WEB www.agavehomeloans.com

AGAVE NMLS #1951574

LICENSES:

Alabama - 1951574

Arizona - 1007729

California DFPI - 60DBO-112121

Colorado - 100517095

Florida - MBR4543

Georgia - 71608

Michigan - FL0023996

Minnesota - MN-MO-1951574

New Jersey - 1951574

North Carolina - L-221352

Oregon -1951574

Pennsylvania - 81635

South Carolina - DCA-1951574

Tennessee - 1951574

Virginia - MC - 7701

Washington - CL-1951574