Good Morning! Summer is cooling off and coming to an end. Thankfully, we can look forward to our fall favorites like pumpkin spice lattes and playing a few rounds of pickle ball. In this high interest rate market, its best to focus on the things that we can control. Our finances one of those factor that we have control over although sometimes it may not seem like it. Recognizing any bad spending patterns we have, putting a plan into action and sticking through to see results. Much like pumpkin spice lattes, we hope this edition gives you something to look forward to as we head into the holiday season!

"Life is a balance between what we can control and what we cannot. Learn to live comfortably between effort and surrender."

Performance Stats (July and August)

$62,281,572 total funded volume

190 Families helped close on a loan!

1. HELOCS vs HELoans: Which is better?

Short answer: it depends! Both are great tools that provide flexibility and access to equity while not impacting your first mortgage. If you qualify, these can be great resources for you to consider!

Home Equity Lines of Credit (HELOCs) and Home Equity Loans are two different financial products that allow homeowners to tap into the equity they have built up in their homes. Both options have their own sets of advantages and disadvantages, and the choice between them depends on an individual's financial goals and circumstances.

Home Equity Line of Credit (HELOC): A HELOC is a revolving line of credit that is secured by the equity in your home. Easily compared to a credit card for your home, HELOCs allow you to draw on your available equity for a period of time. You only pay on what you use and is a great asset if utilized properly.

Pros of HELOC:

Flexibility: HELOCs offer flexibility because you can borrow as much or as little as you need up to your credit limit during the draw period (typically 5-10 years).

Variable Interest Rates: HELOCs often come with variable interest rates, which can be lower initially compared to fixed-rate loans, potentially resulting in lower monthly payments.

Interest-Only Payments: During the draw period, you may only be required to make interest payments, which can keep monthly payments lower.

Tax Deductibility: In some cases, the interest paid on a HELOC may be tax-deductible if the funds are used for home improvements (consult a tax advisor for specifics).

Cons of HELOC:

Variable Interest Rates: While initially lower, the interest rates on HELOCs can fluctuate based on the market, potentially increasing your payments over time.

Risk of Over-Borrowing: The revolving nature of a HELOC can lead to over-borrowing and accumulating more debt than intended.

Balloon Payments: At the end of the draw period, you may be required to make larger payments to repay the principal, which can catch some borrowers off guard.

Impacts to Credit Score: Like a credit card, it is seen as a revolving line of credit. Drawing too much and holding a balance can have negative impacts to credit over time.

Terms Vary: HELOCs can range in how they function depending on the lender. Some may have balloon and pre-payment penalties, others do not. Its best to shop around to make sure you’re getting the best deal

Home Equity Loan: A home equity loan, also known as a second mortgage, provides a lump sum of money upfront, and you repay it with fixed monthly payments over a specified term.

Pros of Home Equity Loan:

Fixed Interest Rate: Home equity loans typically come with fixed interest rates, providing stability and predictability in monthly payments.

Lump Sum Payment: You receive the entire loan amount upfront, which can be useful for large, one-time expenses like home renovations or consolidating multiple debts into one payment

Tax Deductibility: Like HELOCs, the interest paid on a home equity loan may be tax-deductible when used for home improvements (consult a tax advisor for specifics).

Fixed Monthly Payments: You know exactly what the monthly payment will be. Security brings peace of mind and the ability to accurately budget your finances is a gift. Get a longer term to lower the monthly payment while having the flexibility to pay it off sooner if you desire.

Cons of Home Equity Loan:

Infrequent Access: Unlike HELOCs, you can't continually borrow against a home equity loan; you must reapply for a new loan if you need additional funds.

Fixed Monthly Payments: You are required to make fixed monthly payments, which may be less flexible than the interest-only payments during the draw period of a HELOC.

Which Option to Choose and Why: The choice between a HELOC and a home equity loan depends on your specific financial needs and preferences:

HELOC: Consider a HELOC if you need flexibility, anticipate ongoing expenses, or prefer lower initial monthly payments. It can be suitable for projects with uncertain costs.

Home Equity Loan: Opt for a home equity loan if you have a specific, one-time expense, consolidating debts and/or if you prefer the stability of fixed monthly payments among other factors.

Regardless of your choice, it's essential to understand the terms, interest rates, fees, and potential tax implications of these options. Consult with a financial advisor and mortgage professional to determine which option aligns best with your financial goals and circumstances.

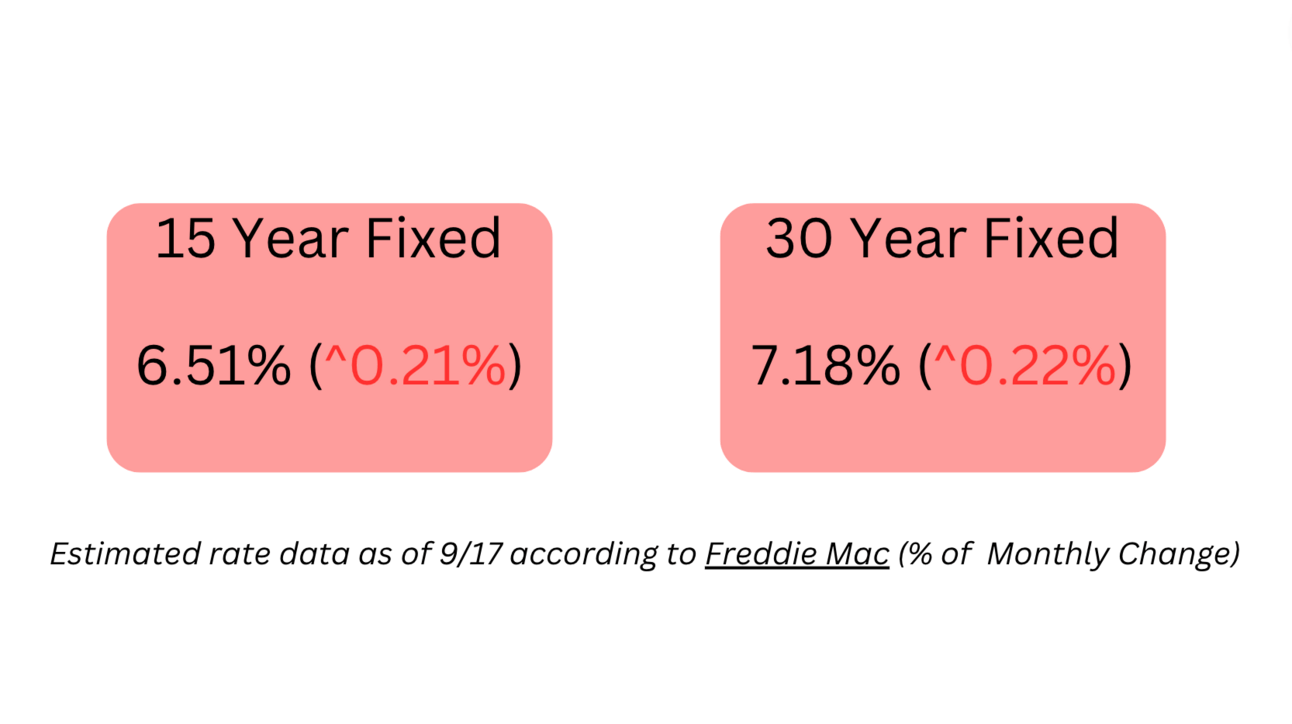

2. Markets Rundown

If you want to find out what discounted rates are based on your personal profile, please fill out this form .

Rates are up from June, July, and August according to Freddie Mac. Shop around providers for the most savings!

3. Cheers to 5-Star Reviews!! We Did it!!✨

We would not have achieved this milestone without our clients giving us a chance to help. Each member of our team works hard everyday to provide value, solve pain points and give a continuing memorable experience. The home buying process can be difficult and overwhelming just as much as finding the best deal when taking equity out of a home. At Agave, we strive to make things simple and easy to accomplish your goals!

Thank you for working with us and here’s to the next 1000 5-star reviews 🥂

4. Budgeting

There’s TONS of free budgeting tools to help you manage your finances. Whether you use your owe excel spreadsheet or write it on a piece of paper, its important to be aware of where your money is going.

Here are a few cool budgeting apps that can help:

1. PocketGuard

2. Mint

3. Every Dollar (Dave Ramsey Debt Snowball)

Let us know on Facebook what your favorite budgeting tool is! We’d love to check it out!

5. Top Mortgage News

Major Lawsuit May Change How We Buy/Sell Homes Forever (BusinessInsider)

Home Equity Loans on the rise in 2023 (Bankrate)

Squeeze on Banks may restrict lending requirements? (Reuters)

Fed pauses rate hike for now (NBC)

(Articles are not endorsed in any matter by Agave Home Loans)

6. Sticky Media: Richest Man in Babylon

This months’ media really hit home and is a great reminder to take a look at how we manage our finances. We may overlook small actions or even point blame on others on why our financial situations are less than perfect. This book illustrates lessons that will open your perspective on obtaining wealth, keeping it and planning for your future. Besides winning the lottery, creating success can be easy if we focus on the right things. Increase our pay, save our money, and invest in the right ventures.

The Richest Man in Babylon" by George S. Clason is a classic in the world of personal finance and wealth-building. Set in ancient Babylon, it imparts essential financial principles through engaging stories. The book revolves around the character of Arkad, the richest man, who shares his wisdom with a group of eager learners seeking financial prosperity. Through Arkad's teachings, readers discover lessons on saving, investing, and managing money wisely. The book emphasizes the importance of living within one's means, setting aside a portion of income for savings and investments, and making informed financial decisions. With its simple yet powerful advice, "The Richest Man in Babylon" offers a practical roadmap to financial success and has remained a valuable resource for those looking to build and grow their wealth

8. Follow us on Facebook!

We're thrilled to invite you to join our Facebook community 🎉

By following our Facebook page, you'll be the first to:

✨ Get updates on our team, services and latest products available to you.

📢 Hear about exclusive promotions, events and giveaways.

📚 Gain access to valuable tips, tricks, and industry insights.

👥 Connect with like-minded individuals who share your interests.

It's super easy to stay in the loop – just click the "Follow" button on our page, and you'll be all set!

Here's the link to our Facebook page: https://www.facebook.com/agavehomeloans

We can't wait to connect with you on Facebook and share our journey together. Thank you for being an essential part of our community! 🌟

7. Sweet Visuals: Index Activity 2023

Purchasing Activity Over Time

Source: Mortgage News Daily

Refinancing Activity Over Time

Source: Mortgages News Daily

Want More Agave?

Subscribe to our Youtube channel!. We are still ramping up but you’ll get access to:

Market deep-dives & discussions

Realtor Interviews: in’s and out’s of the real state market

Deeper understanding of complex mortgage topics

Loan Officer trainings and a backstage look at what it takes to be a Loan Officer

See you on YouTube!

If you have worked with us in the past, please write a review on Yelp! We truly appreciate all clients we have helped in the past and reviews help us in so many ways.

Be sure to follow us on Facebook, Instagram, Twitter, YouTube and LinkedIn for finance tips, positive news stories, giveaways, and so much more!

Did you like this edition of the newsletter?

***

AGAVE HOME LOANS

MORTGAGE BROKERAGE

PHONE 888.300.3440

EMAIL [email protected]

WEB www.agavehomeloans.com

AGAVE NMLS #1951574

LICENSES:

Arizona - 1007729

California DFPI - 60DBO-112121

Colorado - 100517095

Florida - MBR4543

Georgia - 71608

Michigan - FL0023996

Montana - 1951574

North Carolina - L-221352

Oregon -1951574

Pennsylvania - 81635

South Carolina - DCA-1951574

Tennessee - 1951574

Virginia - MC - 7701

Washington - CL-1951574

New Jersey - 1951574

Alabama - 1951574