Good Morning! We hope you’re settling into the new year with clarity and momentum. With the holiday season officially behind us, now is the perfect time to shift from spending mode to strategy mode—and start making your money work more intentionally for you.

This edition, we’re focusing on smart ways to optimize what you already have. From using a modern Adjustable Rate Mortgage (ARM) to immediately improve cash flow and build long-term wealth, to exploring how home equity can be leveraged to regain financial control after the holidays, this edition is all about engineering a stronger financial future.

This Month’s quote: ““The key to success is not prediction, but preparation.”

— John Wooden

What’s The Rate?

Average rates for primary homes with % changes according to Freddie Mac

Top Mortgage News

AI tools improve workflows, but open doors for fraud and manipulation (ScotsmanGuide)

Highest Existing Home Sales in 8 Months (MND)

NAR Pending Home Sales Report Shows 3.3% Increase in November (NAR)

Half of U.S. renters expect to be ready for homeownership within four years (NMP)

(Articles are not endorsed in any matter by Agave Home Loans)

Performance Stats

$37,471,588 Total Funded Volume in November

157 Families helped close on a loan!

The Strategic Pivot: Refinancing into an ARM to Engineer Your Financial Future

Last month, we discussed the ARM as a powerful tool for homebuyers. This month, we're looking at the strategic refinance—how homeowners can use the modern ARM to immediately lower their monthly costs and fund their next financial goal.

In today's market, the ARM offers a rate that is often a half to a full percentage point lower than a 30-year fixed loan. This isn't just a small discount; it's a significant monthly savings that you can immediately put to work.

The Immediate Benefit: Cash Flow Engineering

When you refinance from your current fixed rate into a new, lower-rate ARM, the immediate benefit is a substantial reduction in your monthly payment.

Scenario (Based on a $400k Loan) | Current Rate | New ARM Rate | Monthly Savings (Approx.) |

|---|---|---|---|

Refinance | 6.5% | 5.5% | $257 per month |

Annual Savings | $3,084 per year |

This freed-up cash flow is the strategic advantage. You can use this money not just to save, but to actively engineer your financial future:

Accelerate Debt Payoff: Direct the $257/month savings toward high-interest debt (like credit cards or car loans) to pay them off years faster.

Fund a Down Payment: Allocate the savings to a down payment fund for an investment property.

Invest in Your Home: Use the savings to pay for that spring renovation with cash instead of credit.

The Compounding Power of $3,084

The most powerful use of this freed-up cash is to invest it. By directing that $3,084 annual savings into a tax-advantaged account like a Roth IRA, you are not just saving money—you are building long-term wealth.

Here is how that annual savings could grow over time, assuming a conservative 7% annual return:

Timeframe | Total Contributed | Compounded Value |

|---|---|---|

10 Years | $30,840 | ~$42,500 |

20 Years | $61,680 | ~$133,000 |

That small monthly mortgage savings is the seed for a six-figure investment portfolio.

The Strategic Exit: Built-in Flexibility

The modern ARM is designed for the homeowner who is confident in their future plans.

The Planned Refinance: You use the ARM's low rate for the first few years, build equity, and then refinance into a lower, long-term fixed rate when the market is more favorable. The cost of refinancing is quickly recouped by the monthly savings you've enjoyed.

The Protection: Today's ARMs are safe. They come with clear, non-negotiable caps on how much the rate can adjust, ensuring your payment won't skyrocket unexpectedly.

The ARM is a sophisticated tool for the homeowner who sees their mortgage not as a fixed burden, but as a flexible asset to be optimized. It’s about making your mortgage work harder for your immediate financial goals.

How To Get A Home Equity Loan or HELOC With Bad Credit

With the holiday season behind us, many homeowners are now facing the reality of higher balances on credit cards and personal loans. If you’ve built equity in your home but have a low credit score, using that equity to pay down accrued holiday debt may feel out of reach. The good news is that even with bad credit, qualifying for a Home Equity Loan (HEL) or HELOC can still be possible.

Key Things to Know About Home Equity Loans With Bad Credit:

Credit Score Requirements: Most lenders require a minimum credit score of 620 for second-lien home equity products, though 680+ is preferred. Borrowers below 680 often need strong compensating factors to qualify.

The Right Lender Matters: Big banks and credit unions tend to have strict rules, while mortgage brokers and non-bank lenders often offer more flexible programs for lower credit scores.

Compensating Factors Can Help: Strong home equity (80% LTV or less), a low debt-to-income ratio, stable income, cash reserves, and recent on-time payments can significantly improve approval chances—even with bad credit.

HELOC vs. Home Equity Loan:

Fixed-rate home equity loans are often easier to qualify for with lower credit because they offer predictable payments. HELOCs carry variable rates and may be viewed as riskier by lenders.

Cash-Out Refinance as an Alternative:

For borrowers with lower credit scores, FHA or VA cash-out refinances may allow more flexibility—but refinancing isn’t ideal if you already have a great mortgage rate or if refinancing does not provide significant financial benefit.

A Home Equity Loan or HELOC can still be a smart financial move for homeowners with bad credit—if they work with the right lender and choose the right strategy. With proper planning and a focus on strengthening your application, unlocking your home’s equity is often within reach.

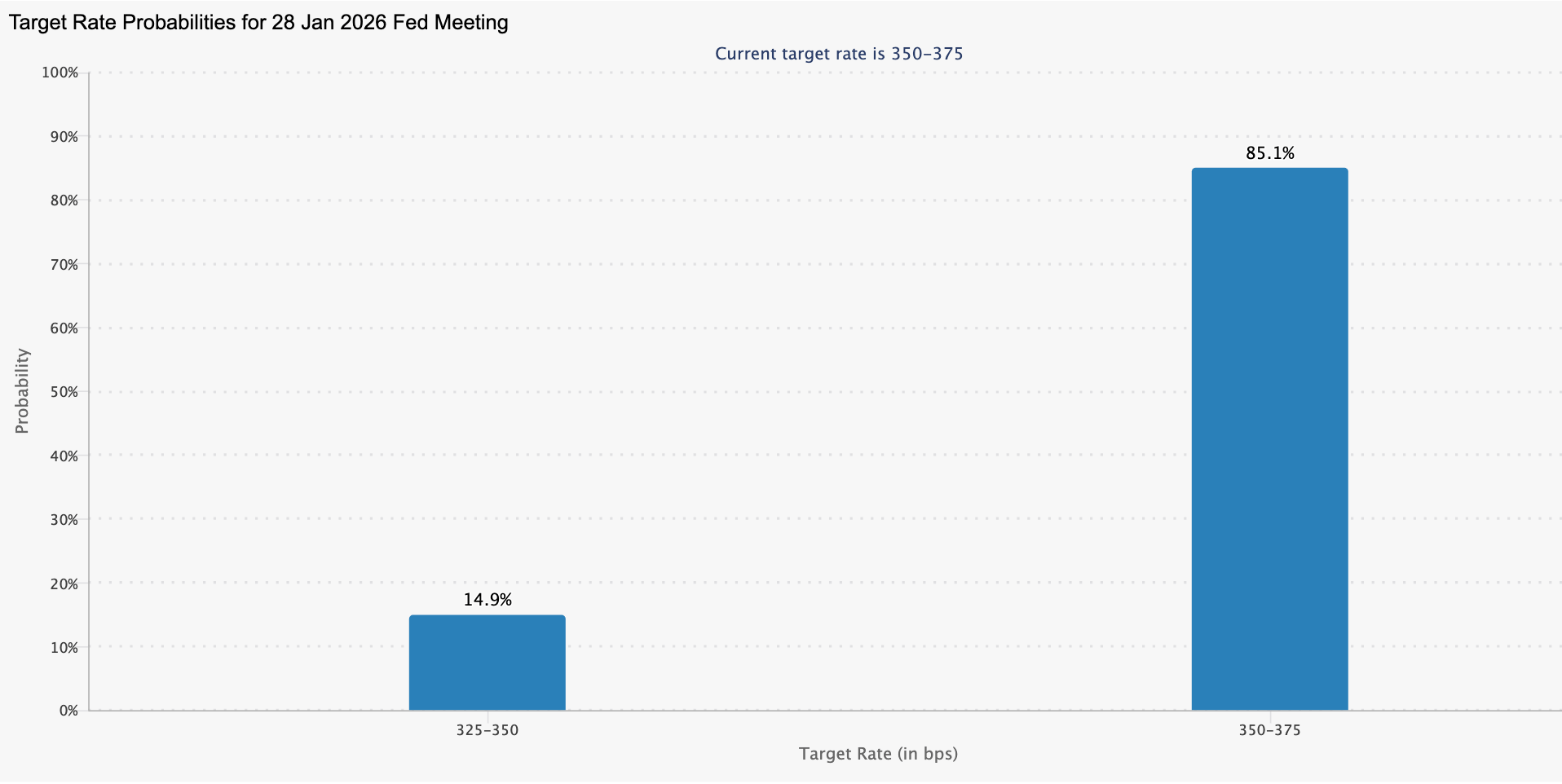

Sweet Visuals: January Fed Rate Drop Prediction

Fed Rate Prediction for January Meeting: 85.1% chance rate remains the same

Source: FedWatch

Fear and Greed Index

Note: When the stock market is calm and not swinging wildly due to fear or greed, the bond market tends to be more stable, leading to less dramatic day-to-day changes in mortgage rates.

A neutral index is a positive sign for anyone seeking stability and predictability in their home buying or refinancing journey.

Source: CNN

Sticky Media: The 5am Club by Robin Sharma

After a season of holiday fun, it's time to get back to business and build some serious momentum for the new year. This book is the ultimate guide to doing just that. The 5 AM Club isn't just about waking up early; it's a powerful philosophy for maximizing your productivity, protecting your focus, and building the mental toughness you need to win in life and business.

Sharma introduces the concept of the "Victory Hour," a structured 60-minute routine you complete before anyone else is awake. This isn't about burning out; it's about investing in yourself first. By mastering your mornings, you gain a massive, compounding advantage over your competition. If you're looking for a simple, actionable strategy to upgrade your discipline, boost your energy, and achieve your biggest goals, this book is the blueprint for your best year yet.

Be sure to follow us on Facebook, Instagram, and LinkedIn for finance tips, mortgage news, giveaways, and more!

Did you like this edition of the newsletter?

***

AGAVE HOME LOANS

MORTGAGE BROKERAGE

PHONE 888.300.3440

EMAIL [email protected]

WEB www.agavehomeloans.com

AGAVE NMLS #1951574

LICENSES:

Alabama - 1951574

Arizona - 1007729

California DFPI - 60DBO-112121

Colorado - 100517095

Florida - MBR4543

Georgia - 71608

Michigan - FL0023996

Minnesota - MN-MO-1951574

New Jersey - 1951574

North Carolina - L-221352

Oklahoma - ML017604

Oregon - 1951574

Pennsylvania - 81635

South Carolina - DCA-1951574

Tennessee - 1951574

Virginia - MC - 7701

Washington - CL-1951574

Wisconsin- 1951574BR