Good Morning! We hope you had a Merry Christmas and a Happy Holiday season. The office was filled with laughter and joy as we wrapped up 2023 with a Christmas themed celebration. Celebrating our successes and failures helps us evolve to become better versions of ourselves. Recognizing how far we have come in our journey in helping others achieve homeownership, we still have have much to go. We thank you all for staying on this path with us and we wish you and your family nothing but the best wishes!

"The joy of brightening other lives becomes for us the magic of the holidays." - W.C. Jones

Performance Stats

$21,992,151 total funded volume

74 Families helped close on a loan!

1.Tis the Season to Lower Your Rate…

The market saw record highs for interest rates in 2023 which means that if you closed on a loan during this time, there may be several opportunities to lower your interest rate in 2024. As rates drop, streamlining your interest rate into todays market could save you hundreds of dollars per month. From paying more expensive Private Mortgage Insurance with FHA loans to locking in 6%+ rates, your going to want to learn more about getting these reduced!

Navigating Refinance Options: Streamline, Rate and Term, and IRRL

Refinancing a mortgage can offer homeowners various benefits, from lowering monthly payments to reducing interest rates. However, the process can seem daunting, especially with different options available. Understanding the differences and similarities between streamline, rate and term, and Interest Rate Reduction Refinance Loan (IRRL) can help homeowners make informed decisions.

Streamline Refinance:

Designed to simplify the refinancing process, particularly for FHA and VA loans.

Typically requires minimal documentation and underwriting, making it faster and easier.

May not require a home appraisal or credit check.

Main goal is to lower monthly payments or secure a more favorable interest rate.

Limited to existing FHA or VA loan holders.

Rate and Term Refinance:

Involves replacing an existing mortgage with a new one, typically to adjust the interest rate or the loan term.

Borrowers can change their interest rate, loan term, or both.

May require a home appraisal and full underwriting process.

Offers flexibility to tailor the new loan to better suit financial goals.

Available for conventional, FHA, VA, and USDA loans.

IRRL (Interest Rate Reduction Refinance Loan):

Specifically for VA loans, aiming to lower interest rates and monthly mortgage payments.

Streamlined process with minimal documentation and underwriting.

Generally does not require a home appraisal or credit check.

Borrowers cannot receive cash proceeds from the loan.

Ideal for veterans and service members looking to reduce their mortgage interest rates quickly.

Key Similarities:

All three options involve refinancing an existing mortgage.

Aim to provide financial benefits to homeowners, such as lower monthly payments or reduced interest rates.

Streamline processes with fewer requirements compared to traditional refinancing.

Can be utilized to adjust loan terms or secure more favorable interest rates.

Key Differences:

Streamline refinance is specific to FHA and VA loans, while rate and term refinance is available for various loan types.

IRRL is exclusively for VA loans and has specific eligibility criteria tied to military service.

Documentation and underwriting requirements vary, with streamline refinance typically being the least stringent.

Cash-out refinancing, which allows borrowers to receive cash proceeds from the loan, is not available with streamline or IRRL refinancing.

Understanding these differences and similarities can empower homeowners to choose the right refinancing option based on their specific needs and circumstances. Consulting with a mortgage professional can also provide valuable guidance in navigating the refinancing process effectively.

Want to see how much we can lower you rate and the savings you’d have every month? Reach out to us today for a complimentary mortgage review!

2. Markets Rundown

If you want to find out what discounted rates are based on your personal profile, please fill out this form .

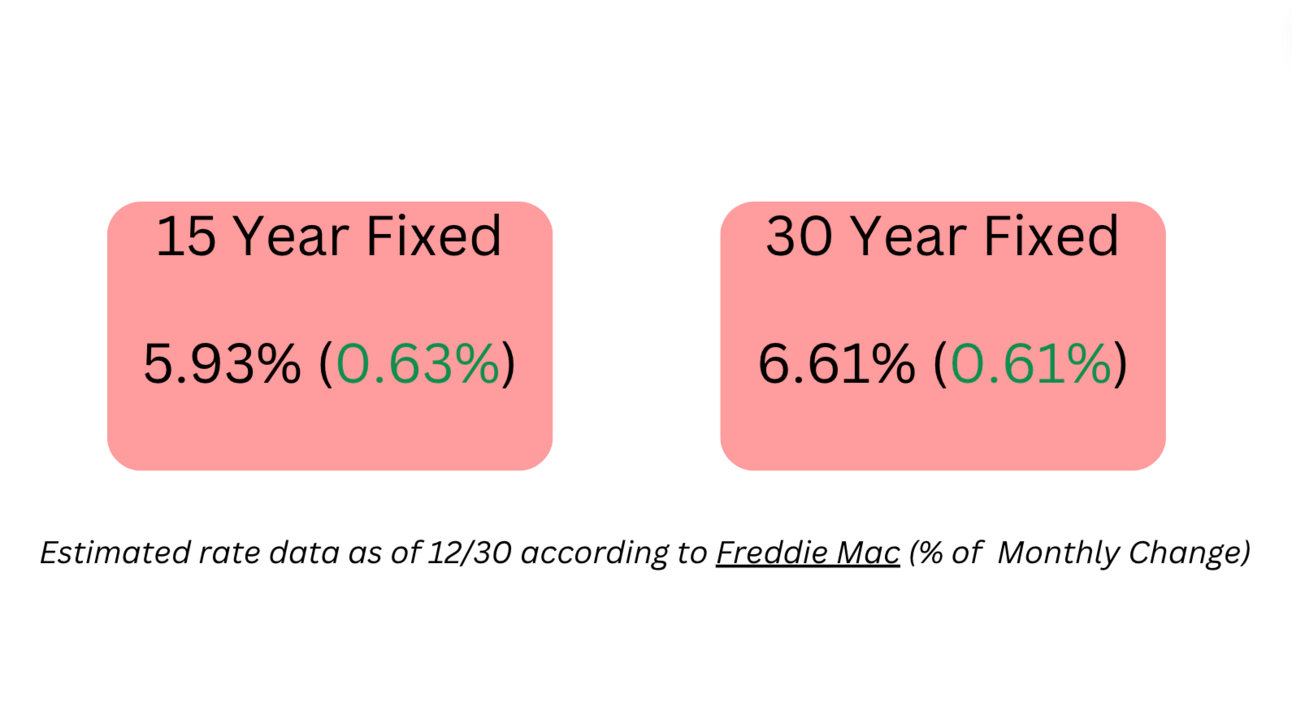

Rates are down from November according to Freddie Mac

3. Did You know….?

Here’s something you likely didn’t know about a Rate and Term Refinance that will help you save even more money per month. Who woulda thought?

Check out our LinkedIn for more fun tips and stay in the loop with the mortgage industry!

Here’s something else you probably didn’t know…

Agave Home Loans won several awards from one of our lending partners Rocket Mortgage, being one of their top brokers!

4. Top Mortgage News

Rate and Term Picks up in December(Scotsman Guide)

Home Sales Rose 8.3% (National Association of Realtors)

Home Buyer Confidence Up (Yahoo)

(Articles are not endorsed in any matter by Agave Home Loans)

5. Sticky Media:

Although we hate the word “Dummy”, this is sticky media makes the home buying process simple and easy. We all start somewhere and beginning with the barebones overview gets the job done.

Home Buying Kit for Dummies" is a helpful book for people who want to buy a home but don't know where to start. It gives easy-to-understand advice and step-by-step instructions on everything you need to know about buying a house. It covers topics like understanding the housing market, getting your finances ready, finding the right mortgage, negotiating the price, and closing the deal. The book also helps you learn how to research neighborhoods, figure out how much a house is worth, and avoid making common mistakes. Whether you're new to buying a home or have done it before, this book is a great guide to help you through the process and make smart decisions about buying your dream home.

6. More Sellers = More Opportunity

The news we’ve been looking to hear. Here are some future outlooks according to HousingWire and CNBC

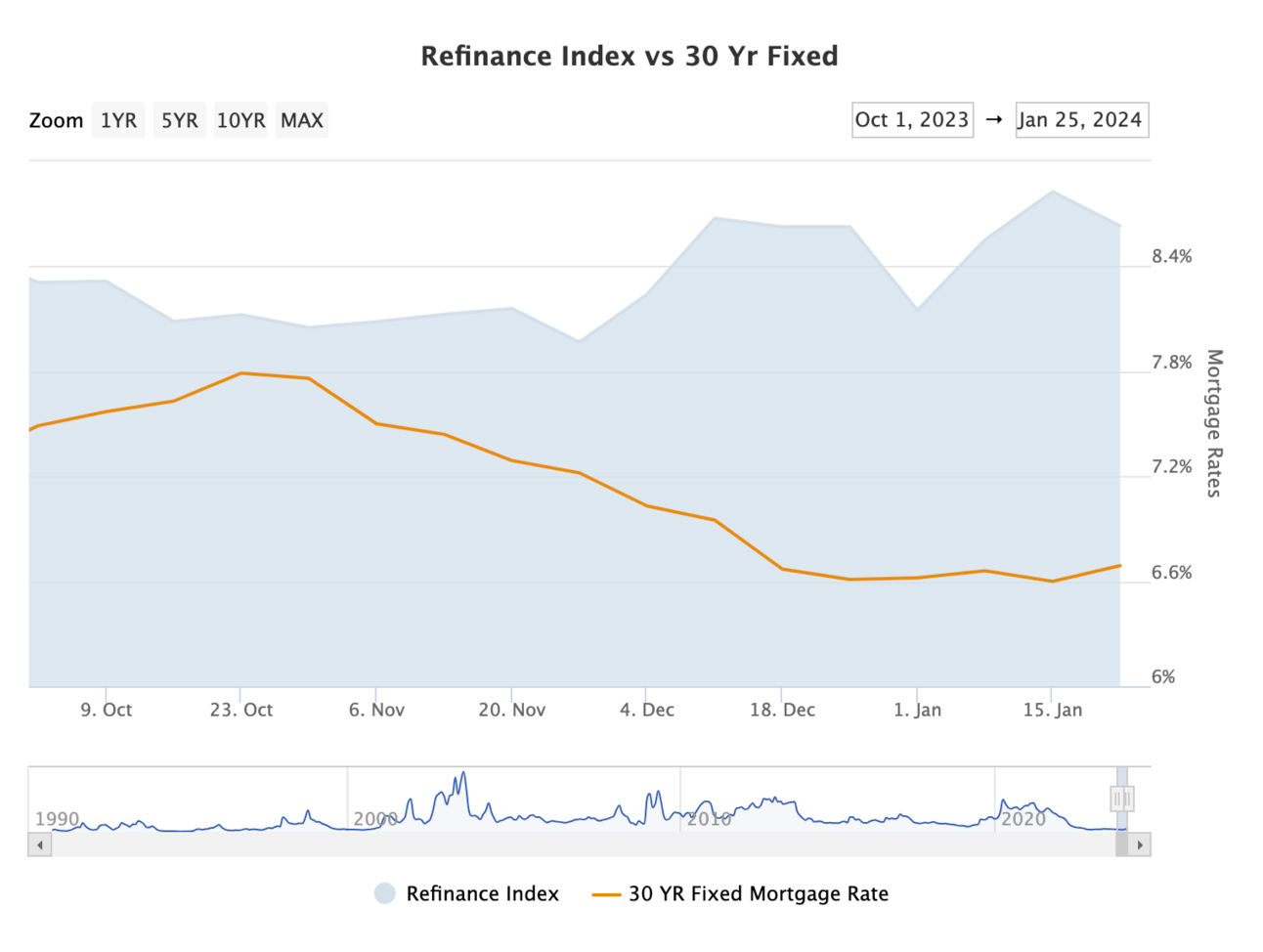

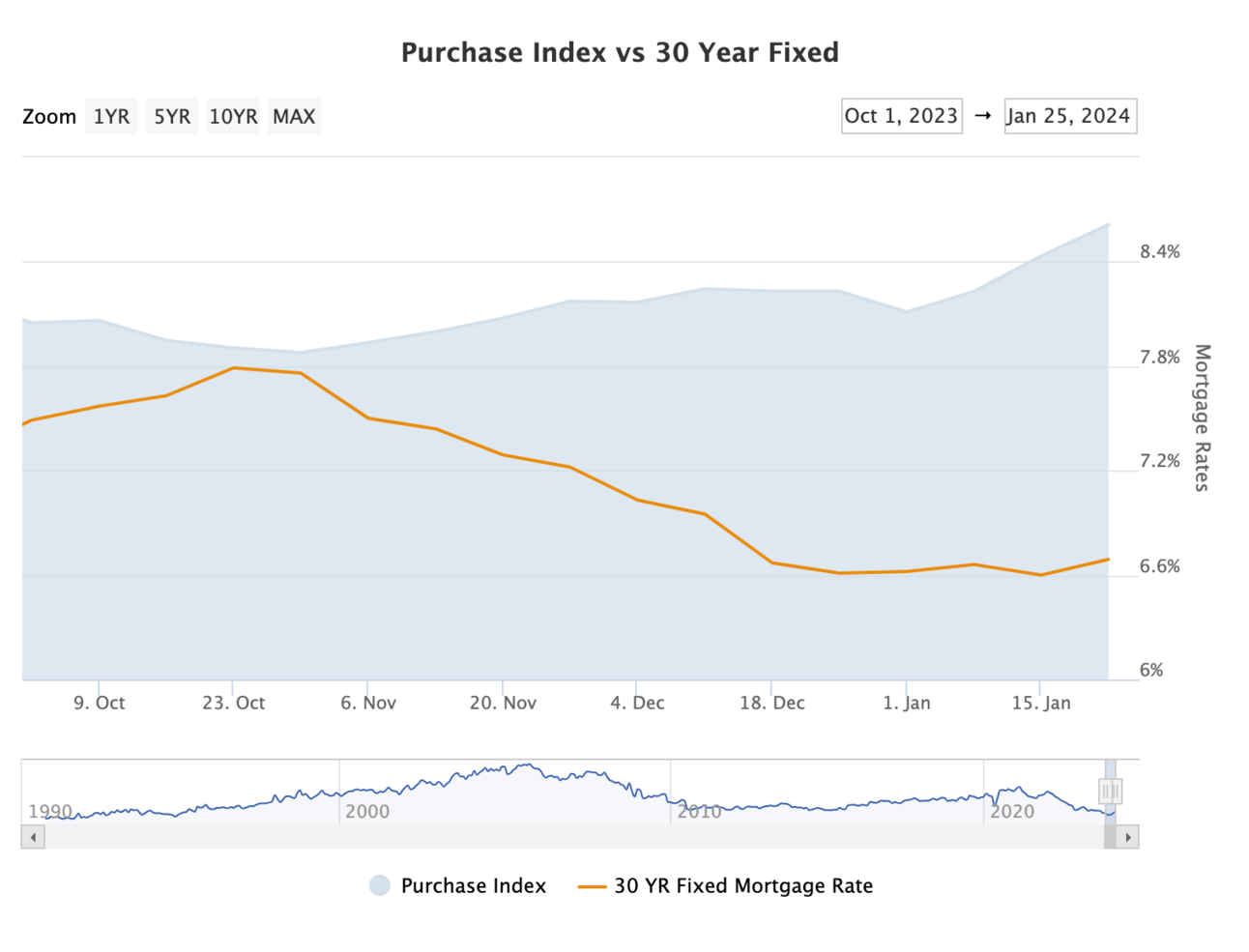

7. Sweet Visuals: Q4 Mortgage Applications

Average Refinance Mortgage Applications from October 2023 to Jan 2024

Average Purchase Mortgage Applications from October 2023 to Jan 2024

Source: Mortgage News Daily

Comparing from our last edition, notice the average rate decline of ~0.5% and an increase of mortgage applications ~1%

If you have worked with us in the past, please write a review on Yelp! We truly appreciate all clients we have helped in the past and reviews help us in so many ways.

Be sure to follow us on Facebook, Instagram, Twitter, YouTube and LinkedIn for finance tips, positive news stories, giveaways, and so much more!

Did you like this edition of the newsletter?

***

AGAVE HOME LOANS

MORTGAGE BROKERAGE

PHONE 888.300.3440

EMAIL [email protected]

WEB www.agavehomeloans.com

AGAVE NMLS #1951574

LICENSES:

Arizona - 1007729

California DFPI - 60DBO-112121

Colorado - 100517095

Florida - MBR4543

Georgia - 71608

Michigan - FL0023996

Montana - 1951574

North Carolina - L-221352

Oregon -1951574

Pennsylvania - 81635

South Carolina - DCA-1951574

Tennessee - 1951574

Virginia - MC - 7701

Washington - CL-1951574

New Jersey - 1951574

Alabama - 1951574