Good Morning! We’re excited to officially announce the new name for our newsletter: The Blue Agave.

Internally, we've always called our valued past clients our "Blue Agaves." It represents the strong, lasting relationships we aim to build. We're adopting this name for the newsletter because it perfectly captures our vision: to build the most informed and empowered community in real estate.

Our promise to you remains the same. Each month, "The Blue Agave" will deliver:

Clear Market Analysis: The real estate and mortgage news you need, without the jargon.

Actionable Tips: Practical strategies to help you build equity, save money, and make smarter financial decisions.

Expert Insights: Deep dives into topics like cash-out refinances, HELOCs, and preparing for your next home purchase.

Our goal is to make every subscriber feel like a "Blue Agave." Thank you for being a part of this community. Now, let's get to this month's edition.

This Month’s quote: "An investment in knowledge pays the best interest."

— Benjamin Franklin

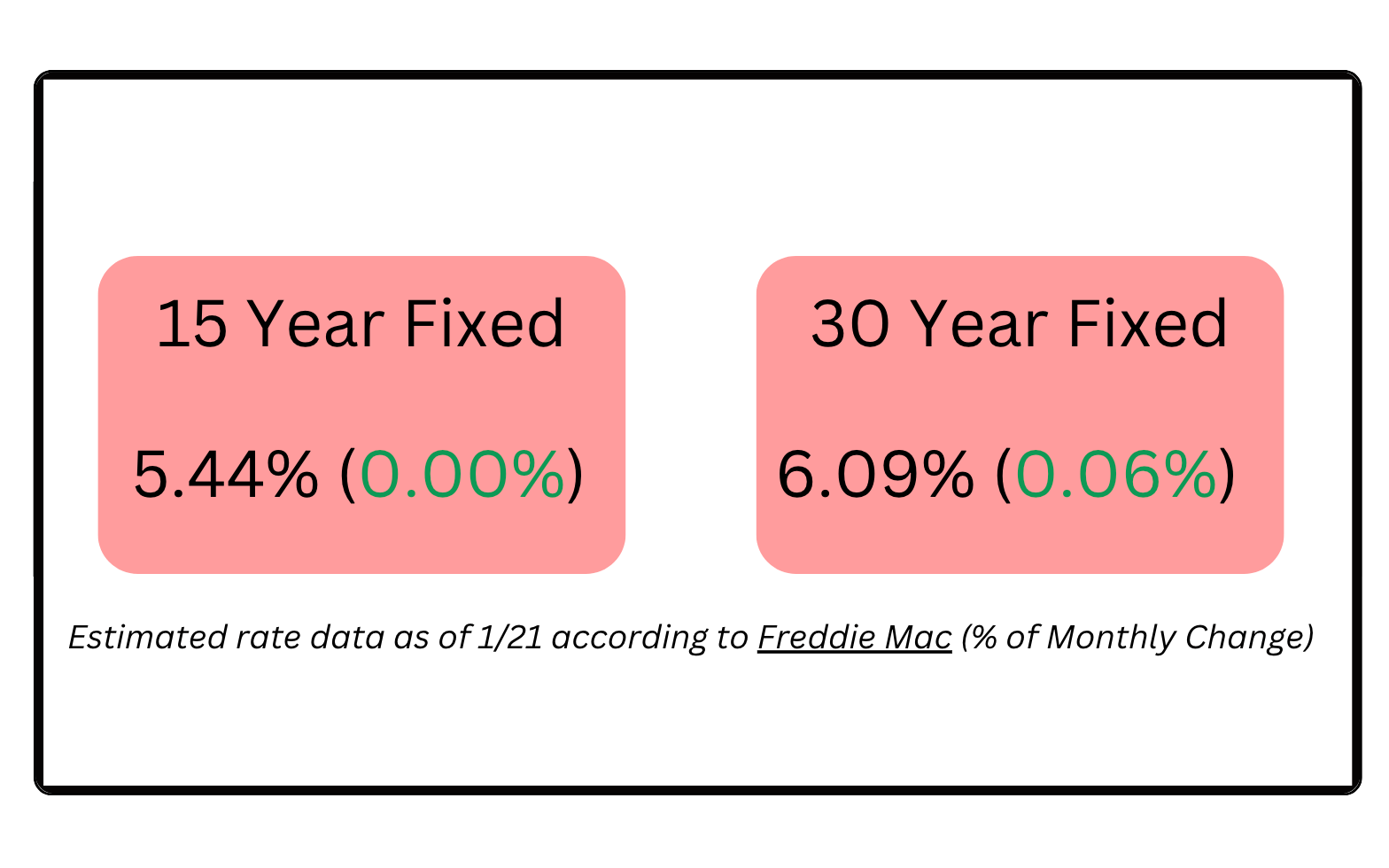

What’s The Rate?

Mortgage Rates Remain the Lowest in 3 Years!

Average rates for primary homes with % changes according to Freddie Mac

Top Mortgage News

Proposed Ban on Buying Single-Family Homes Introduces Uncertainty (CNBC)

Climate, weather, and soaring insurance premiums are driving homeowners to rethink where they live (NMP)

Senior-held home equity has tripled since 2006, doubled since 2020 (ScotsmanGuide)

Trade Groups Call For Cuts To Mortgage Costs For Homebuyers (NMP)

(Articles are not endorsed in any matter by Agave Home Loans)

Performance Stats

$44,553,961 Total Funded Volume in December

178 Families helped close on a loan!

The Escrow Deep Dive: Is Your Escrow Account Costing You Money?

If you have a mortgage, you're likely paying for PITI — Principal, Interest, Taxes, and Insurance. Your lender collects the "T" and "I" payments and holds them in an escrow account, paying your bills on your behalf. It's a convenient, "forced savings" plan.

But that convenience comes at a cost. The money in your escrow account is your money, and it typically earns zero interest.

The Realistic Opportunity

Let's run some honest math. Your escrow balance fluctuates, so we'll calculate interest on the average balance, which is roughly half of your total annual tax and insurance costs.

Scenario: Your annual tax and insurance bills total $8,400.

Estimated Average Balance: $4,200

Gross Annual Interest (at a conservative 3.5% HYSA rate): $4,200 * 0.035 = $147

Net Gain (after 25% tax): You'd pocket a realistic $110 per year.

An extra $110 a year isn't a lottery win, but it's "found money." Reinvested, it can grow significantly over time thanks to the power of compounding. It's about turning a passive account into an active tool for wealth creation.

How to Make the Switch in 4 Steps

Check Your Eligibility: First, ask your lender about an "escrow waiver." You typically need at least 20% equity in your home.

Open a Dedicated HYSA: Open a separate High-Yield Savings Account and name it "Home Taxes & Insurance." This is not a slush fund.

Automate Your Savings: Calculate your total annual cost, divide by 12, and set up an automatic monthly transfer into your new HYSA.

Pay the Bills Yourself: You are now responsible for paying the bills directly. Mark the due dates on your calendar!

Pro-Tip for Tax Season: Worried about funding the new account? A tax refund is the perfect way to jumpstart your self-managed account, giving you an instant head start on your first big payment.

Is This Strategy Right for You?

This approach requires discipline.

It's GREAT for: Homeowners who are organized, comfortable managing their own bills, and want to maximize every dollar.

Stick with Escrow if: You value the "set it and forget it" convenience or worry about missing a payment. The peace of mind from a traditional escrow account is a valuable asset in itself.

Knowing you have a choice is the first step to being an empowered homeowner.

Using a Term Reduction Refinance to Pay Off Your Mortgage Faster

With inflation, market uncertainty, and retirement planning top of mind, many homeowners are looking for ways to eliminate long-term debt sooner. If you have a 30-year mortgage but stronger income or equity than when you first bought your home, a term reduction refinance may be a smart way to pay off your mortgage faster and save significantly on interest.

By refinancing into a shorter loan term—such as a 15- or 20-year mortgage—you can accelerate payoff while building equity at a much faster pace.

Key Things to Know About a Term Reduction Refinance:

Shorter Term = Less Interest: Refinancing from a 30-year to a 15-year mortgage can save tens or even hundreds of thousands of dollars in interest over the life of the loan, depending on your balance and rate.

Higher Payments, Bigger Long-Term Gains: Monthly payments will increase, but more of each payment goes toward principal, helping you build equity faster and eliminate debt sooner.

Tax Refunds Can Help Offset Payments: Many homeowners use their annual tax return to cushion the higher monthly payment or make a lump-sum principal payment early in the loan, reducing interest even further and paying off the home years faster!

Who This Works Best For: Borrowers with stable income, room in their budget, lower loan balances, or those nearing retirement often benefit the most from a shorter-term refinance.

Rates Are Often Lower: Shorter-term mortgages typically offer lower interest rates than 30-year loans, further increasing long-term savings.

Alternatives Exist: If refinancing doesn’t make sense, applying your tax refund toward principal, making extra monthly payments, or using a bi-weekly payment strategy can still shorten your loan term.

A term reduction refinance can be a powerful strategy for homeowners focused on long-term financial freedom—but only if the payment fits comfortably within your budget.

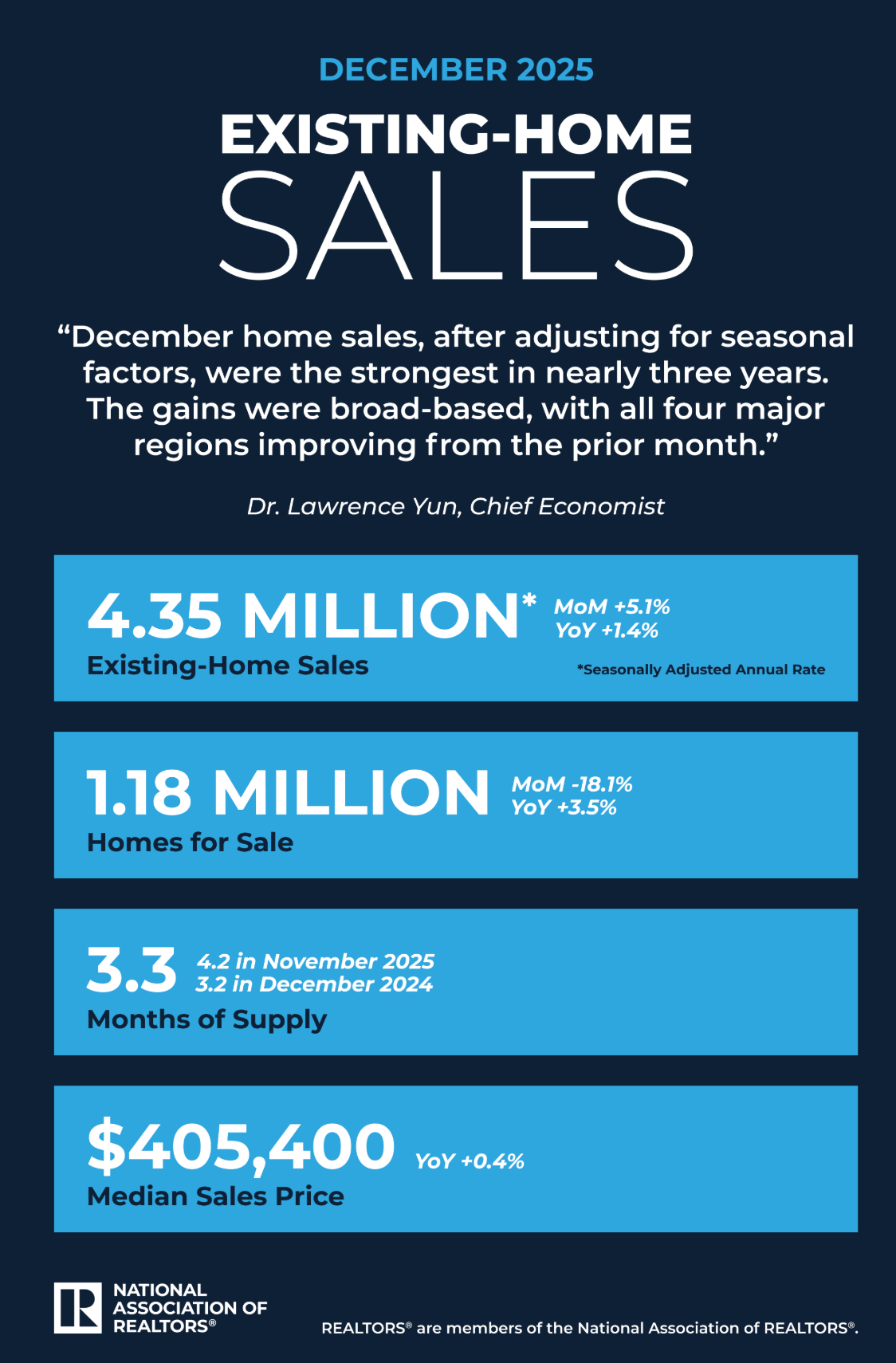

Sweet Visuals: December Existing Home Sales

Source: NAR

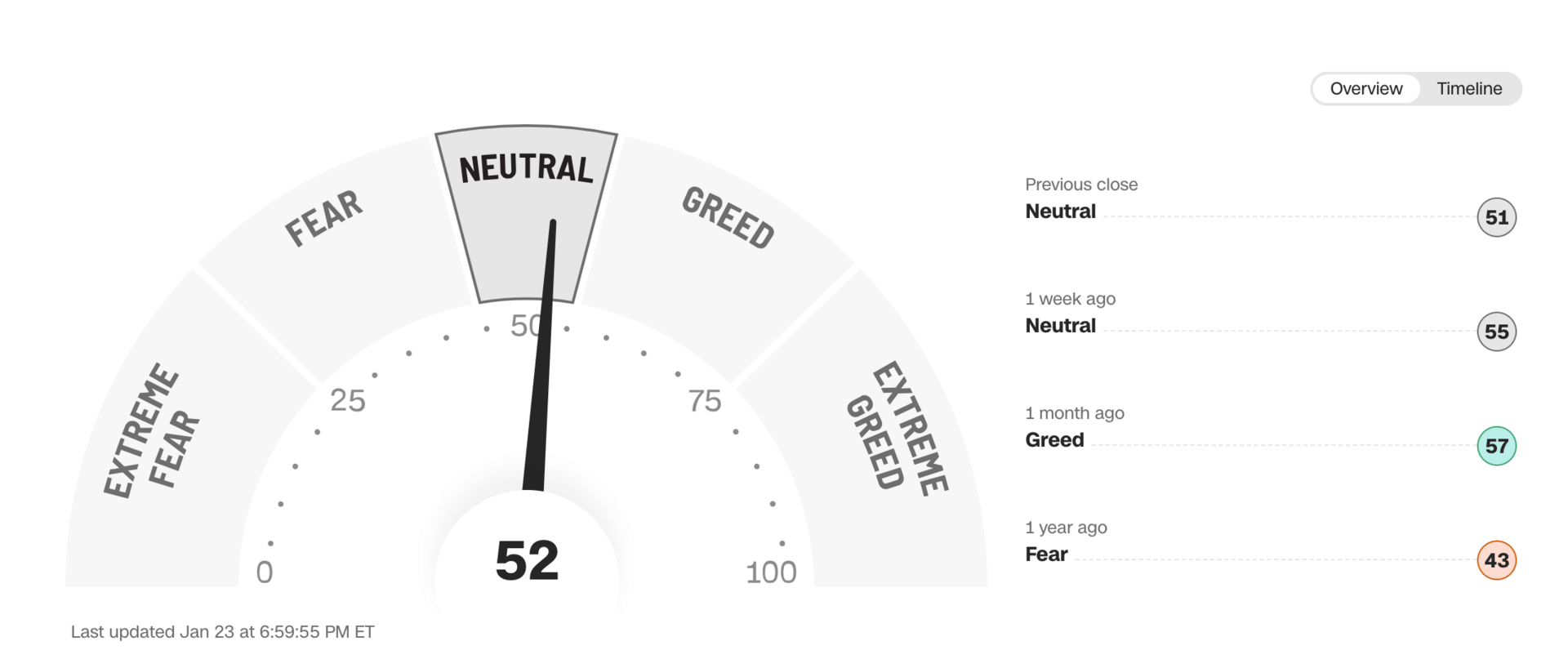

Fear and Greed Index

Note: When the stock market is calm and not swinging wildly due to fear or greed, the bond market tends to be more stable, leading to less dramatic day-to-day changes in mortgage rates.

A neutral index is a positive sign for anyone seeking stability and predictability in their home buying or refinancing journey.

Source: CNN

Sticky Media: Four Thousand Weeks, Time Management for Mortals

After the rush of goal-setting and big resolutions, this book offers a much-needed reality check on how time actually works. Four Thousand Weeks starts with a simple, humbling truth: the average human life is only about 4,000 weeks long. Once you truly absorb that, your relationship with time, productivity, and priorities can’t help but change.

Burkeman challenges the idea that better systems, tighter schedules, or more discipline will ever let us “get on top” of life. Instead, he argues that peace and progress come from accepting limits, choosing what truly matters, and letting go of the endless pressure to do it all. This isn’t about doing less out of laziness—it’s about doing the right things with intention. If this year is about clarity, focus, and meaningful momentum (not burnout), this book is a powerful reminder that time isn’t something to manage—it’s something to live wisely.

Be sure to follow us on Facebook, Instagram, and LinkedIn for finance tips, mortgage news, giveaways, and more!

Did you like this edition of the newsletter?

***

AGAVE HOME LOANS

MORTGAGE BROKERAGE

PHONE 888.300.3440

EMAIL [email protected]

WEB www.agavehomeloans.com

AGAVE NMLS #1951574

LICENSES:

Alabama - 1951574

Arizona - 1007729

California DFPI - 60DBO-112121

Colorado - 100517095

Florida - MBR4543

Georgia - 71608

Louisiana - 1951574

Michigan - FL0023996

Minnesota - MN-MO-1951574

New Jersey - 1951574

North Carolina - L-221352

Oklahoma - ML017604

Oregon - 1951574

Pennsylvania - 81635

South Carolina - DCA-1951574

Tennessee - 1951574

Virginia - MC - 7701

Washington - CL-1951574

Wisconsin- 1951574BR