Your home is one of your most powerful financial assets, and it's time to put it to work for you. We're proud to feature our 5-Day Home Equity Line of Credit as this month's sponsor

Good Morning! Wishing you a happy and inspired start to your week. In this July edition, we're celebrating independence in all its forms—especially financial independence. We'll explore how veterans can unlock powerful homeownership benefits and how a simple shift in mindset can lead to greater wealth and freedom. If you're ready to declare independence from stressful rates and build a more secure future, this issue is for you. Let's get started!

“Financial freedom is freedom from fear.” — Robert Kiyosaki

What’s The Rate?

Average rates for primary homes with % changes from May according to Freddie Mac

Top Mortgage News

Is there any chance of a Fed rate cut in July? (Scotsmanguide)

US Homeowners Insurance Rates Rose 40.4% in Six Years (Insurance Journal)

Economy Trump says he believes Powell is ready to start lowering rates (CNBC)

NAR Existing-Home Sales Report Shows 2.7% Decrease in June (NAR)

HELOC and home equity loan rates tick lower (Bankrate)

(Articles are not endorsed in any matter by Agave Home Loans)

Performance Stats

$32,464,853 Total Funded Volume in May

129 Families helped close on a loan!

A Smart Financial Tool for Veterans: Home Equity Line of Credit

As a veteran, you understand the importance of having reliable and flexible tools at your disposal. A Home Equity Line of Credit (HELOC) works the same way for your finances. It allows you to borrow against the equity you've built in your home, providing a revolving line of credit you can use as needed.

Think of it as a strategic resource. For veterans, a HELOC can be a powerful way to:

Fund Adaptive Home Renovations: Make your home more accessible or comfortable without draining your savings.

Consolidate High-Interest Debt: Combine credit card or personal loan payments into a single, lower-interest payment, freeing up monthly cash flow.

Invest in Your Future: Cover educational expenses for a new career path or start a business.

Unlike a traditional loan, you only pay interest on the funds you draw, giving you control and flexibility. It’s a practical way to leverage your home's value to achieve your next set of goals.

Curious how a HELOC could work for you?

Our team is here to help you explore your options without the pressure.

Click Here to Learn More or you can get started on a HELOC today!

*All loans subject to credit approval. Not available in all states/properties. Consult a loan officer for full terms and conditions.

Unlock Financial Freedom with a VA Streamline Refinance (IRRL)

For veterans and service members with a VA loan, achieving financial independence just got easier. If you're looking to lower your monthly mortgage payment, one of the most powerful tools available is the VA Interest Rate Reduction Refinance Loan (IRRRL), also known as a "streamline" refinance. It’s designed to be fast, simple, and effective, helping you secure your financial future with less hassle.

This refinance option lives up to its "streamline" name by cutting through the typical red tape. In most cases, you can skip the home appraisal and income verification, which saves you time, money, and stress. The primary goal is simple: to provide a clear benefit, whether that’s reducing your interest rate, lowering your monthly payment, or switching from a risky adjustable-rate mortgage to a stable fixed-rate loan.

Why a VA IRRRL Could Be Your Best Move in 2025

The benefits of a streamline refinance are tailored to make a real difference in your budget. Consider these advantages:

Lower Monthly Payments: The most common reason to refinance is to save money, and an IRRRL is built to do just that.

No Appraisal, No Problem: Save hundreds of dollars and weeks of waiting by avoiding a new home appraisal.

Simplified Paperwork: With no income or employment verification required, the process is significantly faster.

Stability with a Fixed Rate: If you have an adjustable-rate mortgage (ARM), an IRRRL allows you to lock in a predictable fixed rate for peace of mind.

Roll in Your Costs: Many veterans can roll the closing costs into the new loan, meaning little to no out-of-pocket expense.

Key 2025 Update: The 36-Month Recoupment Rule

A crucial requirement for an IRRRL is the "net tangible benefit." This means the refinance must put you in a better financial position. A key part of this is the 36-month recoupment rule, which ensures that all closing costs are paid back by your monthly savings within three years. This regulation protects you by guaranteeing your refinance delivers real, timely savings. If you’ve ever felt that refinancing was too complicated or expensive, the VA IRRRL is designed to challenge that belief. It’s a direct path to improving your financial standing, built specifically for those who have served.

If you want to find out what rates and programs you qualify for based on your personal profile, please fill out this form 👈

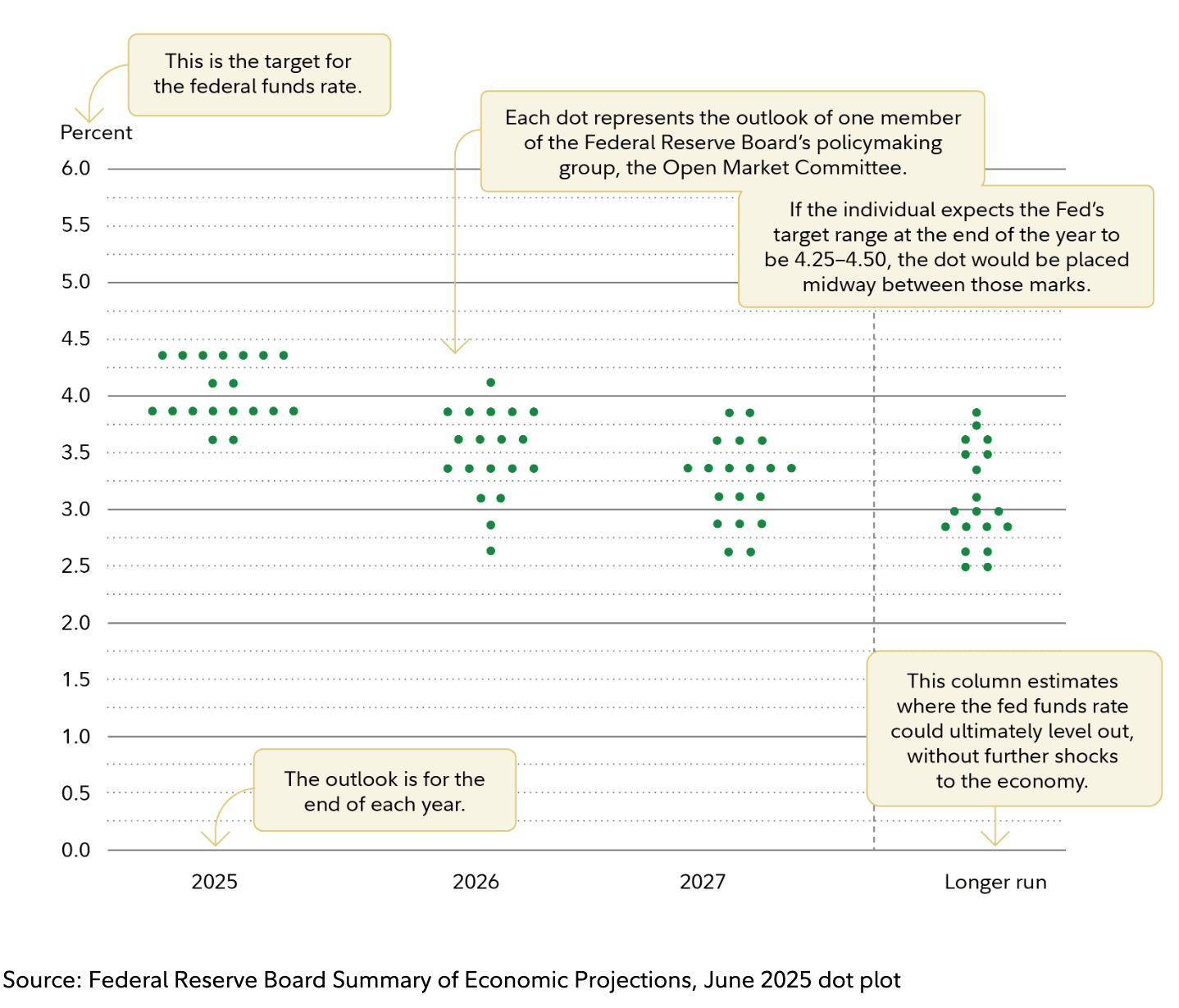

Sweet Visuals: Fed Dot Plot

Federal Committee Predictions Where Interest Rate’s Will Be Over Next 2 Years

Ranging Factors Impacting the Fed Dot Plot

Source: Fidelity

Sticky Media: The Psychology of Money

After exploring how to live a richer life with Die With Zero and how to build tangible assets with The Book on Rental Property Investing, it’s time to look inward. The Psychology of Money by Morgan Housel reveals a fundamental truth: financial success is less about what you know and more about how you behave. It masterfully argues that your relationship with greed, fear, and optimism has a greater impact on your wealth than any spreadsheet or market analysis.

Housel uses 19 short, engaging stories to illustrate how even the smartest people can make financial mistakes because of their emotions and biases. He introduces powerful concepts like the difference between being "rich" (having a high current income) and being "wealthy" (having the freedom and flexibility that comes from unspent assets). The book isn't about chasing the highest possible returns; it's about building a financial life that is resilient enough to survive market volatility and personal setbacks, allowing you to sleep well at night.

This book shifts the focus from complex financial strategies to timeless, behavioral wisdom. It teaches you that the most valuable financial skill is not about numbers, but about humility, patience, and understanding the seductive pull of envy. If you've ever wondered why financial advice that sounds good on paper is so hard to follow in real life, The Psychology of Money provides the essential, human-centered answers you've been looking for.

Be sure to follow us on Facebook, Instagram, and LinkedIn for finance tips, mortgage news, giveaways, and more!

Did you like this edition of the newsletter?

***

AGAVE HOME LOANS

MORTGAGE BROKERAGE

PHONE 888.300.3440

EMAIL [email protected]

WEB www.agavehomeloans.com

AGAVE NMLS #1951574

LICENSES:

Alabama - 1951574

Arizona - 1007729

California DFPI - 60DBO-112121

Colorado - 100517095

Florida - MBR4543

Georgia - 71608

Michigan - FL0023996

New Jersey - 1951574

North Carolina - L-221352

Oregon -1951574

Pennsylvania - 81635

South Carolina - DCA-1951574

Tennessee - 1951574

Virginia - MC - 7701

Washington - CL-1951574